Advertisement|Remove ads.

The S&P 500 Roared In 2025 — But Global Investors Made Bigger Gains Elsewhere

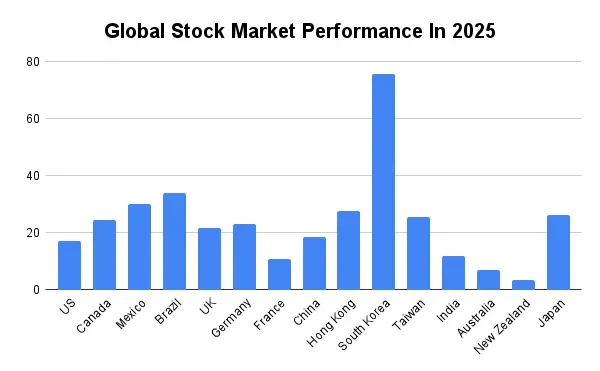

- While the S&P 500 posted an 18.6% gain and outperformed China, it lagged several international peers.

- South Korea’s Kospi emerged as the top-performing major market, supported by heavyweight tech exposure and renewed policy optimism.

- Market leadership across regions was heavily influenced by political developments—ranging from U.S. rate cuts and tariff volatility to Brazil’s reform expectations and leadership changes.

Overall, the global stock market has had a robust year. Despite lingering geopolitical and macroeconomic uncertainties, the bull market continued to push ahead. It’s the time of the year to take stock of which among the global markets delivered superior returns.

U.S. President Donald Trump may have done the chest-thumping for ushering in the golden era of the stock market after he took office for a second time in January. Ironically, Trump upset the markets' rhythm, which had been coming off a robust performance in late 2024, by announcing sweeping tariffs early in the year. The market’s resilience won in the end.

While outperforming China’s main stock market gauge, the S&P 500 Index, a measure of the broader U.S. market performance, trailed many other major markets.

And Crown Goes To….

The best-performing stock market is in a country on the other side of the world. South Korea’s Kospi topped the Class of 2025, and it is a no-brainer as the country is home to some of the biggest tech names, including Samsung, memory chipmaker SK Hynix, and battery maker LG Electronics.

The Kospi suffered a setback in December of 2024 when the then-President Yoon Suk Yeol’s sudden declaration of martial law and remained subdued during the first half of the year due to the Trump tariff threat. The market lifted off in the second half, inspired by President Lee Jae Myung’s pro-market agenda and a global AI boom.

How S&P 500 Fared Versus Rest Of Global Markets

The S&P 500 Index fell in the middle of the spectrum among the major global markets in terms of the year’s performance. The SPDR S&P 500 ETF (SPY), an exchange-traded fund that tracks the S&P 500 Index, has gained 18.6% and trades just shy of its all-time closing high.

*based on Yahoo Finance data

**Returns until Dec. 30 for US, American, and French markets

In the U.S., tech optimism ran high among investors as accelerating artificial intelligence (AI)–related spending translated into tangible revenue growth, higher infrastructure utilization, and improving earnings visibility. Corporate profit growth remained strong, helping to offset fears concerning a potential economic slowdown. FactSet estimates that the cumulative profit of S&P 500 companies is set to increase by 8.3% year over year (YoY) in the fourth quarter, marking the 10th consecutive year of earnings growth.

The Federal Reserve, probably buckling under political pressure, lowered the Fed funds rate by 25 basis points each, thrice. With Trump promising to install a dovish Fed Chair, replacing incumbent Jerome Powell when his current term as chief expires in May 2026, the market has begun baking in additional cuts.

Brazil Takes Silver

Despite the year’s stellar run, the key market gauge, the Bovespa, is down on a five-year basis. In 2025, the stock defied a hawkish central bank that fought hard to bring inflation below the 5% central bank target, a Barron’s report stated. The economic growth, however, remained resilient.

“What’s driving the bull run this year is the prospect for change in 2026,” said Malcolm Dorson, head of emerging markets strategy at Global X ETFs. President Luiz Inácio Lula da Silva is expected to retire after the elections in October 2026, given the not-so-robust health of the octogenarian.

Hong Kong, Japan Other Standout Asian Markets

Hong Kong’s Hang Seng and Japan's Nikkei 225 were among the best-performing Asian markets, gaining about 28% and 27%, respectively. The Japanese market, though, was volatile during the year.

Daiju Aoki, UBS SuMi Trust Wealth Management regional chief investment officer, said, “The market is increasingly being driven by politics,” Japan Times reported. While tariffs initially roiled the market, a resolution to the issue and the change of guard in the political arena helped the market recover nicely. Sanae Takaichi, considered a fiscal dove, won the ruling Liberal Democratic Party’s leadership race in October and was later named president.

The Outlook

Most economists and strategists believe the conditions are ripe for the bull market to continue. Morgan Stanley’s Global Investment Committee said it believes the U.S. stock market still has room to run. “With odds of a recession remaining extraordinarily low and double-digit growth in corporate earnings appearing likely, we see the S&P 500 gaining 10% for the year, reaching around 7,500,” the firm’s strategists said.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: A Low-Hype Software Stock More Than Doubled This Year: What’s Driving It — And Is There Upside Left?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)