Advertisement|Remove ads.

S&P Global Stock Hits All-Time High After Q4 Profit Tops Estimates: Retail’s Elated

S&P Global Inc (SPGI) shares rose 2.7% on Tuesday, hitting a record high after the company’s fourth-quarter earnings topped Wall Street estimates.

On an adjusted basis, the ratings agency reported earnings of $3.77 per share for the quarter ended Dec. 31, compared with average analysts’ estimate of $3.47 per share, according to FinChat data.

Its fourth-quarter revenue rose 14% to $3.59 billion compared to the year-ago quarter, topping a Street estimate of $3.50 billion.

S&P said it is maintaining its target of returning 85% or more of adjusted free cash flow to shareholders through dividends and share repurchases. The company would launch an initial $650 million accelerated share repurchase program in the coming weeks.

Revenue from its ratings unit jumped 27% to $1.06 billion, while market intelligence revenue rose 5% to $1.19 billion.

S&P’s commodity insights unit’s revenue rose 10% to $545 million, while indices revenue jumped 21% to $436 million.

The company makes money by licensing its indexes to other firms that create funds that track the indexes, such as the S&P 500. It also provides analytical data on various subjects and charges fees to companies requesting credit ratings for their bonds and other debt securities.

The company expects adjusted earnings per share to be between $17 and $17.25. Analysts, on average, expect the company to earn $16.92 per share.

S&P also expects 2025 revenue to grow between 5% and 7%.

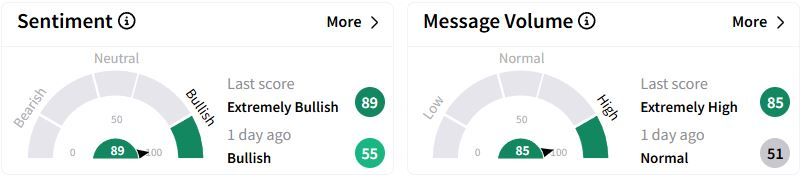

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (89/100) territory from ‘bullish’(55/100) a day ago, while retail chatter rose to ‘extremely high.’

Users praised the company and wondered why the stock is talked about much less than others.

Over the past year, S&P stock has gained 20.8%.

Also See: Phillips 66 Stock Gains Premarket On Reports Of Elliott Acquiring Stake: Retail Turns Exuberant

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1463539842_jpg_bcfa58ea0b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_stock_jpg_167f2bc3dd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_So_Fi_new_6d7889a863.webp)