Advertisement|Remove ads.

Phillips 66 Stock Gains Premarket On Reports Of Elliott Acquiring Stake: Retail Turns Exuberant

Phillips 66 (PSX) shares gained over 6% in premarket trade on Tuesday, headed toward their highest level in over two months after reports surfaced that activist investor Elliott Investment Management has built a stake in the oil refiner valued at more than $2.5 billion.

On Monday, the Wall Street Journal reported that Elliott would push the company to sell or spin off its midstream business.

Phillips 66 operates about 72,000 miles of pipelines in the U.S. and ships refined products, crude oil, natural gas, and natural gas liquids nationwide.

The segment, largely insulated from the volatility in oil and gas prices due to fixed rates, posted earnings of $2.68 billion in 2024.

Elliott first unveiled a $1 billion stake in Phillips 66 in 2023 and said it was underperforming rivals Marathon Petroleum and Valero Energy.

Last year, Phillips 66 named former Shell executive Robert Pease to its board with Elliott’s blessings, and the investor gradually reduced its stake.

However, the Wall Street Journal reported, citing people familiar with the matter, that Elliott still believes Phillips 66 hasn’t fulfilled its commitment to further board changes.

The report added that the stake would make Elliott among the top five shareholders of the oil refiner.

Elliott, founded by hedge fund manager Paul Singer, has recently targeted several companies, including Southwest Airlines and Honeywell. The latter announced a three-way split earlier in February.

Several reports over the weekend have said Elliott has also built a stake in the major British oil company BP.

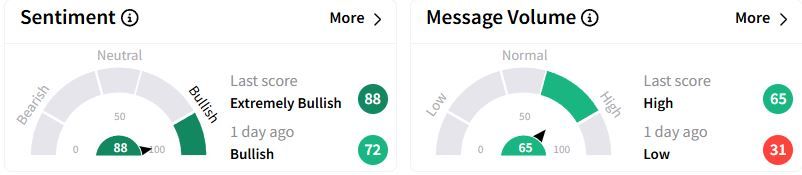

Retail sentiment on Stocktwits jumped to ‘extremely bullish’ (88/100) territory from ‘bullish’(72/100) a day ago, while retail chatter rose to ‘high.’

Over the past year, Phillips 66 stock has fallen 15.4%.

Also See: BP Stock Falls Premarket After Q4 Profit Miss: Retail Shrugs It Off

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)