Advertisement|Remove ads.

Saatvik Green Energy, Nila Infra Surge As New Contracts Spark Investor Optimism

Saatvik Green Energy and NILA Infrastructure saw strong gains on Wednesday on the back of bagging multi-crore orders. Saatvik shares rose 5% to ₹483 in morning trade on Wednesday. While Nila Infrastructure surged 11%, its best intra-day performance in over four months.

Saatvik Green Energy

Shares of Saatvik Green Energy hit a fresh high after the company secured multiple domestic orders worth a combined ₹707.62 crore for the supply of solar photovoltaic (PV) modules from several leading independent power producers (IPPs) and engineering, procurement, and construction (EPC) firms.

The first set of contracts, valued at ₹488 crore, has been awarded for the supply of solar PV modules to renowned IPPs and EPC players. Additionally, the company’s subsidiary, Saatvik Solar Industries, has received repeat orders worth ₹219.62 crore from three prominent IPPs and EPCs for similar supplies.

All the orders are expected to be executed within FY26.

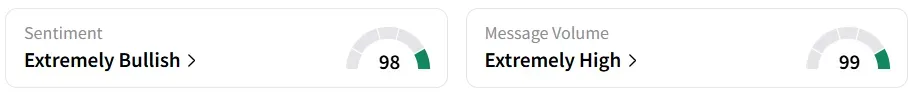

Retail sentiment on Stocktwits turned ‘extremely bullish’ from ‘neutral’ a session earlier, amid ‘extremely high’ market chatter.

On September 26, Saatvik Green Energy made soft market debut, listing at a 1% discount on the BSE with an opening price of ₹460 against its issue price of ₹465. Meanwhile, on the NSE, the stock is listed at par.

Nila Infrastructures

Nila Infrastructures received a Letter of Acceptance (LOA) from the Ahmedabad Municipal Corporation (AMC) for the development of a slum rehabilitation project under the Pradhan Mantri Awas Yojana on a public-private partnership (PPP) basis.

The project involves the construction of 728 housing units and 25 commercial shops. The total development cost is ₹105.02 crore, for which the company will receive Transferable Development Rights worth ₹56.51 crore and balance free-sale land measuring 4,209.67 sq. metres, valued at ₹48.51 crore.

The project is expected to be completed within 30 months.

Year-to-date, the stock has shed 13.3%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)