Advertisement|Remove ads.

SAIL Stock Dips Ahead Of Q1: SEBI RA Flags Technical Strength, Short-Term Range Trade

Steel Authority of India (SAIL) shares fell over 4% on Friday ahead of their June quarter (Q1 FY26) earnings report. The street estimates a steady show, and will be monitoring steel volumes, prices and margin growth.

SEBI-registered analyst Deepak Pal noted that the stock is in a short-term consolidation phase ahead of its upcoming earnings announcement, which may lead to increased volatility.

On its technical charts, SAIL is currently showing a bullish trend on the daily chart, trading above all key Exponential Moving Averages (EMAs), which indicates strong underlying momentum.

The Relative Strength Index (RSI) stands around 58, reflecting moderate strength, while the Moving Average Convergence Divergence (MACD) remains flat and close to the signal line, supporting the consolidation view.

Pal believes that if the stock reacts positively to the result and continues its rally, it could move towards the ₹149–₹150 levels. On the downside, a dip towards the ₹129–₹130 support zone can be seen as a long-term buying opportunity, provided the bullish structure remains intact.

On the fundamentals, he highlighted that while the company benefits from strong operational scale and public sector support, its recent financial performance reflects pressure on profitability.

Despite a moderate valuation (P/E 24x, P/B 0.95x), its return ratios, such as return on equity (4.1%) and return on capital employed (5.5%), remain low. It has moderate debt (D/E 0.63) but limited liquidity, as indicated by a low quick ratio.

Overall, he concluded that while SAIL holds long-term potential, its current fundamentals suggest it may be suitable only for patient investors waiting for a steel sector rebound.

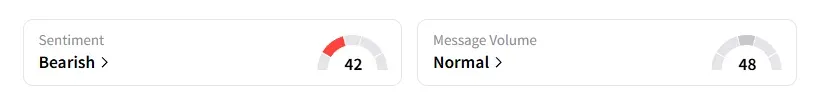

Data on Stocktwits shows that retail sentiment turned ‘bearish’ a day ago on this counter.

SAIL is a government-owned Maharatna company and one of India’s largest steel producers. Its shares have risen 15% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2200882557_jpg_53f3e467bc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Seagate_jpg_50a56724b4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)