Advertisement|Remove ads.

Super Micro Stock Rises Premarket As Investors Await Word On Financial Report Filing: Retail Braces For Liftoff

Super Micro Computer, Inc. (SMCI) stock appears on track to snap a three-session slide even as investors turned nervous over whether the company will keep its tryst with its Nasdaq deadline for becoming current with its financial report filings.

The San Jose, California-based artificial intelligence (AI) server maker’s stock began to rally hard in early February amid the rollout of a fully production-ready AI data center solution powered by Nvidia Blackwell architecture and its second-quarter business update.

Although the second-quarter and full-year 2025 guidance was weak, investors latched on to the next fiscal year’s revenue outlook of $40 billion.

Notwithstanding the three-session sell-off, triggered partly by the broader market weakness, Super Micro stock is up over 69% year-to-date (YTD).

Super Micro stock was on a tear in early 2024 due to its exposure to the hot-and-happening AI technology. On March 8, it hit an all-time high of $122.90.

However, a series of adverse developments, including a delay in the filing of financial reports, concerns raised by the then-auditor Ernst and Young (EY) about accounting and internal controls and the firm’s subsequent resignation, a short report that alleged accounting manipulation and the company's removal from the Nasdaq 100 Index all depressed sentiment toward the stock.

With Super Micro not being concurrent with its filings for the fiscal year 2024 and the first and second quarters of the fiscal year 2025, the risk of a potential delisting from the Nasdaq loomed large. Extending the deadline for filing the financial reports to Feb. 25 provided some relief.

The D-day has dawned. All eyes are trained on the company, expecting a positive outcome.

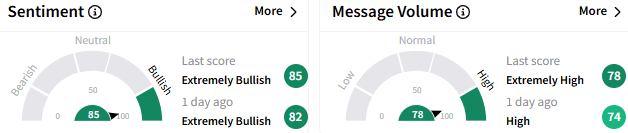

Notwithstanding the looming risk, retail sentiment toward Super Micro stock remained ‘extremely bullish’ (85/100), with the message volume perking to an ‘extremely high’ level.

The stock was among the top 10 trending tickers on the platform and the most active one early Tuesday.

A retail watcher said they expect the stock to rally, with an easy 20%-30% upside.

Another user said the stock could retest the March all-time highs in the next two months.

In premarket trading, Super Micro stock climbed about 2.50% to $53.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2237640344_jpg_bc97a7240c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2245685477_jpg_ce08eb96cb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2215875671_jpg_b63edc641f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229940320_jpg_5bc20a70df.webp)