Advertisement|Remove ads.

Sarepta Draws Wall Street Ire After Third Patient Death This Year: Analyst Says ‘Deeply Concerning’ The Incident Wasn’t Reported Earlier

Shares of Sarepta Therapeutics (SRPT) tumbled 14% on Friday after a patient reportedly died following treatment with one of the firm’s gene therapies, drawing concerns from Wall Street analysts.

A company spokesperson told Bloomberg that a 51-year-old patient died of acute liver failure last month in an early-stage trial of a gene therapy to treat limb-girdle muscular dystrophy. Limb-girdle muscular dystrophy (LGMD) is a group of genetic conditions causing progressive muscle weakness and wasting, primarily affecting the muscles around the shoulders and hips.

The company is already under pressure following the death of two patients following treatment with its gene therapy for Duchenne Muscular Dystrophy called Elevidys earlier this year.

Following the news, Morgan Stanley analyst Michael Ulz said that the news adds to the ongoing safety concerns and near-term uncertainty around Sarepta.

Leerink, meanwhile, opined that Sarepta management, knowing of a limb-girdle muscular dystrophy patient death in the trial and not disclosing it when announcing a restructuring earlier this week, is "deeply troubling and further undermines credibility."

The firm added that it is “deeply disappointed in management's repeated execution missteps."

While this is the first patient death reported in a limb-girdle muscular dystrophy trial, it is the third death reported by Sarepta this year across its gene therapy programs, William Blair told investors in a research note. Blair pointed out that Sarepta did not disclose the third patient death in its recent business update, which it termed "unfortunate and concerning.”

Last month, the U.S. Food and Drug Administration said that it is probing the death of two pediatric patients with Duchenne Muscular Dystrophy (DMD) following treatment with Elevidys. The agency said it is investigating the risk of acute liver failure with serious outcomes, including hospitalization and death, following Elevidys and is evaluating the need for further regulatory action.

Earlier this week, the company announced that it would eliminate 500 jobs, or approximately 36% of its workforce, as part of a restructuring effort aimed at achieving $400 million in annual cost savings. Sarepta also stated that it has agreed to the FDA’s request to include a black box warning in the ELEVIDYS label for acute liver injury and acute liver failure, to address the agency’s concerns regarding the use of the therapy in DMD patients who can walk.

The company has halted shipments of the therapy to patients who cannot walk and is in talks with the FDA regarding a possible resumption.

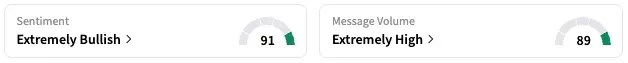

On Stocktwits, retail sentiment regarding Sarepta is trending in “extremely bullish” territory at the time of writing, accompanied by “extremely high” message volume.

A Stocktwits user opined that the company destroyed the possibility of profitability or partnerships with the recent news.

SRPT stock is down over 85% this year and by 87% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)