Advertisement|Remove ads.

SBI Q1 Preview: Street Eyes Modest Growth; SEBI RAs Flag Support Around ₹800

State Bank of India, the country’s largest private sector bank, is scheduled to report its first quarter results later on Friday. According to street estimates, SBI is likely to post modest growth in both net interest income (NII) and profit for Q1FY26, due to increased funding costs and RBI rate cuts from June.

SBI shares were marginally up at ₹806.30 in early trade.

Fundamentally, SBI has delivered a 5-year profit CAGR of 36.3% and maintained a steady dividend payout of 18.2%. However, concerns include a declining interest coverage ratio, significant contingent liabilities, and a large portion of profits coming from other income, said SEBI-registered analyst Rohit Mehta.

SBI’s last quarter earnings numbers offer a mixed picture. Revenue grew 8.1% year-on-year and 1.9% quarter-on-quarter. However, pre-tax profit declined 6.8% YoY, even though it saw a 5.2% QoQ improvement. EPS also slipped 8.35% YoY but edged up nearly 4% sequentially.

For Q1FY26, loan growth, NIM, and slippage trends are key metrics to keep an eye on.

Technical Analysis

On its technical charts, SBI formed a rounded bottom pattern between March and May 2025, often seen as a bullish reversal signal, Mehta added.

It is currently holding above the key support zone of ₹780 - ₹800, a level that has been tested multiple times. If the stock can sustain above ₹800 and decisively break past the ₹858 resistance, momentum may resume toward its all-time high of ₹894, Mehta said.

SEBI RA Deepak Pal noted that the stock is nearing resistance at the 20-day and 50-day exponential moving averages (EMA), with the Parabolic SAR signaling a potential trend reversal.

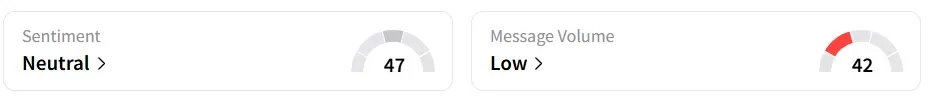

While the MACD remains negative, it is flattening, and the relative strength index (RSI) at 49 indicates neutral momentum.

A breakout above ₹810 - ₹815 could pave the way toward ₹830, while immediate support rests at ₹790 - ₹785. Long-term investors should look at buying the dips, Pal said.

Retail sentiment for SBI on Stocktwits turned ‘neutral’ from ‘bearish’ a day earlier.

Year-to-date, the stock has seen a marginal 1.2% increase.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Goldman_Sachs_resized_c6a47f630c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_cybertruck_jpg_7f6ed70b80.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Nebius_jpg_291bb409c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202349941_jpg_3f45878d03.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_marathon_holdings_resized_40790d98cc.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)