Advertisement|Remove ads.

Sensex, Nifty Today: Indian Stocks Face 5th Day Of Losses On Trump's Pharma Tariffs — SEBI RAs Flag Key Levels to Watch

Dalal Street opened under pressure once again on Friday, with all major sectoral indices declining. The benchmark Indian indices are on track for a fifth consecutive session of losses.

At 10:15 a.m. IST, the Nifty 50 index was down 0.41% at 24,788.55, while the Sensex fell 0.45% to 80,796.30. 36 of the 50 constituents of the Nifty50 index were trading lower.

Markets were dragged lower by strong selling in pharmaceutical stocks after US President Donald Trump declared a 100% tariff on branded and patented pharmaceutical products starting Oct. 1.

The Nifty Pharma index was down 2.3% in early trade, with Natco Pharma (-4.7%), Laurus Labs (-3.7%), and Biocon (-3.3%) leading the declines. Sun Pharma was down 2.9%, while Dr Reddy's fell 1.2%.

The United States remains the largest export destination for Indian pharmaceuticals, accounting for 31% of the country's $27.9 billion pharma exports in FY24, as per data from the Pharmaceuticals Export Promotion Council of India.

Broader markets followed a similar trend, with the Nifty Midcap 100 index falling 0.81% and the Nifty Smallcap 100 index slumping 1.2%.

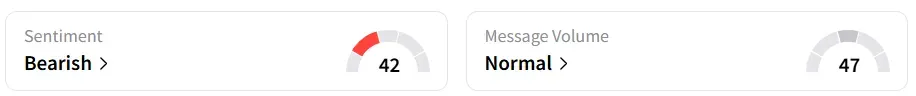

Retail sentiment for the Nifty50 remained 'bearish' as the selloffs continued. It was 'bullish' last week.

Stock Watch

Sun Pharma was the biggest laggard on the Nifty 50 index, followed by IT majors Infosys (-1.7%), Wipro (-1.65%), and Tech Mahindra (-1.6%).

Carysil, a manufacturer and exporter of home furnishing products, fell nearly 8% after Trump announced a 50% tariff on kitchen cabinets and bathroom vanities, and 30% on upholstered furniture.

Shares of beleaguered telecom firm Vodafone Idea dropped 3% ahead of the Supreme Court hearing on the company's plea against the central government's adjusted gross revenue (AGR) demand.

On the other hand, Tata Motors gained 2.2% after its UK subsidiary, Jaguar Land Rover (JLR), announced progress in restoring digital systems that were affected by a cyberattack earlier this month. The stock had shed nearly 3% in the previous session after reports emerged that the cyberattack could cost the company around £2 billion.

RITES surged 5.6% after the public sector undertaking received a Letter of Award from Talis Logistics, South Africa, worth $18 million for supplying and commissioning overhauled Cape gauge ALCO diesel-electric locomotives.

Nazara Technologies was up 1.5% after the stock began trading ex-bonus and ex-split. The company had recently announced a 1:1 bonus issue and a 1:2 stock split.

Bearish Charts

Technically, the 24,900-24,920 zone is a key support area for the Nifty where a short-term pullback could occur. If this level fails to hold, the next significant support lies at 24,800–24,760, coinciding with the 100-day exponential moving average (EMA) and the 61.8% Fibonacci retracement, said SEBI-registered analyst Bharat Sharma

A recovery from these levels will face stiff resistance near 25,000, and reclaiming this mark will be challenging without strong buying momentum.

In the near term, the market is likely to witness "sell on rise" opportunities below 25,000 as sentiment remains weak, Sharma said.

For Nifty, Immediate intraday support is seen at 24,880, below which the index could slide toward 24,800–24,760-24,720, the analyst added.

Resistance is placed around 24,950, and a breakout above this level could trigger a retest of 25,000 and higher levels up to 25,140. Overall, the positional outlook remains bearish with a cautious eye on a potential pullback, Sharma said.

On the charts, Nifty formed a bearish candle, reflecting continued pressure at higher levels. Indicators such as the relative strength index (RSI) have weakened further, suggesting a loss of momentum, while the moving average convergence/divergence (MACD) remains above the signal line but is showing early signs of fatigue, according to ASEBI-registered analyst Mayank Singh Chandel.

Support is now at 24,800-24,750, aligned with the 61.8% retracement and 100-day EMA. A breakdown here could push the index toward 24,700 - 24,600. Resistance lies at 25,000, with a stronger supply zone at 25,100 - 25,150, Chandel said.

Derivatives data confirm these levels, with heavy call writing at 25,000 and 25,100 reinforcing overhead resistance, while fragile support remains at 24,800 and 24,900, he added.

Overall, the trend favors bears unless Nifty reclaims and sustains above 25,000. Until then, further declines toward the 24,600 zone cannot be ruled out, the analyst said.

Nifty faces intraday resistance between 25,009 - 25,075, while support is seen around 24,738–24,800, said A&Y Market Research.

Bank Nifty has resistance levels at 55,055 - 55,168 and support near 54,492 - 54,587. These ranges will likely guide market moves, with a breakout or breakdown signaling the next direction.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)