Advertisement|Remove ads.

Shell Reportedly Mulls Chemical Asset Sales In US, Europe — Will It Sway Retail Bears?

Shell (SHEL) will likely garner attention on Monday after the Wall Street Journal reported that the company is exploring a potential sale of its European and U.S. chemical assets.

The report, citing people familiar with the matter, said that Shell is conducting a strategic review of its chemical operations with the bankers at Morgan Stanley.

The report added that the review is in its early stages, and Shell has not committed to any final decisions.

The report said the assets under review include Shell’s Deer Park facility. The Deer Park plant is located in an area spanning 460 acres and produces chemicals such as ethylene and propylene, which have several industrial applications.

Shell also has chemical plants in the southern state of Louisiana. It also produces chemicals in Germany, the UK, and the Netherlands.

Sluggish recovery in China and other economies has weighed on chemical firms' earnings since the pandemic.

A BCG report from October said that petrochemicals demand growth is on course to weaken over the next ten years due to a decelerating global economy and the shift in economic activity toward less materials-intensive sectors.

The Wall Street Journal report said that potential bidders for the assets could include private equity firms and Middle Eastern buyers wanting to expand into the West.

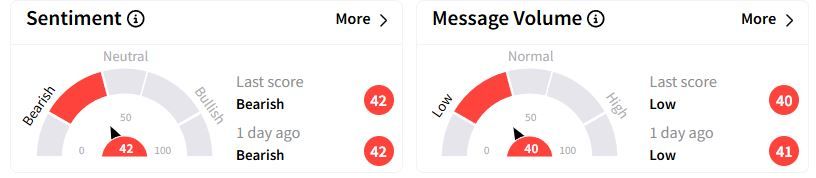

Retail sentiment on Stocktwits remained in the ‘bearish’ (42/100) territory, while retail chatter was ‘low.’

Shell’s adjusted earnings had fallen to $0.60 per share during the fourth quarter from $1.11 per share a year earlier.

Its chemicals and products segment posted an adjusted loss of $229 million during the fourth-quarter, compared with a year-ago profit of $29 million.

In February, the company agreed to buy interests in the Ursa and Europa Fields from ConocoPhillips for $735 million amid CEO Wael Sawan’s efforts to boost its oil and gas output.

Shell’s capital markets day is scheduled for March 25.

Over the past year, Shell’s American Depositary Receipts (ADRs) have gained 6.7%.

Also See: Welltower Bets Big On Senior Housing With $3.2B Deal In Canada: Retail Stays Unmoved For Now

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262606802_1_jpg_86ff244e32.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)