Advertisement|Remove ads.

Shell Tops Q3 Earnings Expectations, Holds Steady On $3.5B Buyback Despite Oil Price Slide

- The oil and gas producer posted adjusted earnings of $5.43 billion, while analysts projected it to report $5.09 billion.

- "Shell delivered another strong set of results, with clear progress across our portfolio and excellent performance in our marketing business and deepwater assets in the Gulf of America and Brazil.” — CEO Wael Sawan.

- Brent crude prices had dropped to nearly $60 per barrel earlier this month amid concerns over OPEC+ oversupply and a spike in trade tensions between the U.S. and China.

Shell (SHEL) stock was in focus on Thursday after the firm’s third-quarter profit topped expectations on the back of strong earnings in its gas division.

The oil and gas producer posted adjusted earnings of $5.43 billion, while analysts had projected $5.09 billion, according to the company's estimates. The firm’s cash flow from operations (CFFO) totaled $12.2 billion in the third quarter, compared with $14.7 billion in the same period last year.

"Shell delivered another strong set of results, with clear progress across our portfolio and excellent performance in our marketing business and deepwater assets in the Gulf of America and Brazil,” said Shell CEO Wael Sawan in a statement.

Shell Pledges $3.5B In Buybacks Despite Oil Price Volatility

The London-listed oil and gas firm said it will buy back shares worth $3.5 billion in the current quarter, maintaining a steady pace despite a pullback in oil prices.

Brent crude prices had dropped to nearly $60 per barrel earlier this month amid concerns over OPEC+ oversupply and a spike in trade tensions between the U.S. and China. This has put a strain on the buyback pledges of the top five Western oil majors, which combined collected over $200 billion in profits in 2022 and decided to return much of it to investors.

BP in April cut its share buybacks to $750 million for the second quarter, compared with $1.75 billion in the previous quarter. Rival TotalEnergies also said last month it would adjust its buyback pace “in order to face economic and geopolitical uncertainties and to retain room to maneuver.”

What Is Retail Thinking?

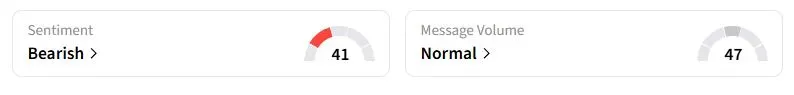

Retail sentiment on Stocktwits about Shell’s U.S. ADR was still in the ‘bearish’ territory at the time of writing. The shares were up marginally in premarket trading.

Shell’s U.S. ADR has gained nearly 20% this year. The firm’s U.S. rivals, ExxonMobil and Chevron, are scheduled to report earnings on Friday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263849665_jpg_4d6eff48f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_janetyellen_resized_jpg_ea2c28f284.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jamie_Dimon_July_736ff90d31.webp)