Advertisement|Remove ads.

Shift4 To Buy Smartpay For $180M To Deepen Australia-New Zealand Footprint: Retail Shrugs For Now

Integrated payments and commerce technology company Shift4 Payments, Inc. (FOUR) agreed to buy Australia’s Smartpay for $180 million.

Smartpay is an independent provider of payment processing and point-of-sale solutions in Australia and New Zealand. It supports more than 40,000 merchants in the region.

Shift4’s purchase price of NZ$ $1.20 per share ($0.71 per share) represented a 46.5% premium to Smartpay’s 90-day trading day volume weighted average price. The New Zealand Stock Exchange-listed shares of Smartpay jumped over 11% on Monday.

The acquisition is expected to close in the fourth quarter of 2025, subject to regulatory approvals.

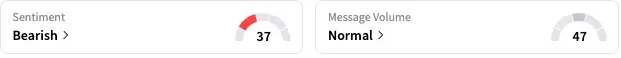

On Stocktwits, retail sentiment toward Shift4 stock was ‘bearish’ (37/100), and the message volume was ‘low.’

Shift4 stock is down over 11% so far this year.

Smartpay sells tailored payment solutions through an extensive distribution network across Australia and New Zealand, supporting a diverse base of more than 40,000 merchants in the region. Subject to regulatory approvals, the acquisition is expected to close in the fourth quarter of 2025.

Shift4 CEO Taylor Lauber said, “This acquisition follows the Shift4 playbook to a tee. It deepens our strategic presence in Australia and New Zealand, providing a significant opportunity to offer our full suite of software and payments solutions in the region.”

The company noted that it has successfully executed a similar strategy of combining acquisitions to deliver an integrated payment experience with localized distribution, service, and support, valuable merchant-facing products, and owned payment rails to rapidly scale in other regions, most recently in Germany, the UK, and Ireland.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_OG_jpg_3ac8291bf2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994915_jpg_357c625963.webp)