Advertisement|Remove ads.

Shopify Stock Drops Despite Q4 Beat On ‘Conservative’ Profit Outlook, But Retail Sentiment Hits Year-High

Shopify Inc. (SHOP) shares fell more than 2% in morning trading Tuesday despite the e-commerce platform exceeding Wall Street’s fourth-quarter earnings expectations. The decline appears driven by investor concerns over the company’s profit outlook.

In pre-market trade, the stock slipped as far as 7% below Monday’s closing price.

Shopify was the third-highest trending ticker on Stocktwits at the time of writing.

Q4 was "a strong close to another good year," according to Jefferies analyst Samad Samana, who views the market reaction as the stock "hitting the wall of high expectations (along with a premium valuation) rather than a fundamental disappointment."

The company posted earnings per share (EPS) of $0.44, slightly ahead of the $0.43 consensus estimate.

Revenue came in at $2.8 billion, surpassing analysts' expectations of $2.73 billion and marking a 31% year-over-year increase.

"The Q1 2025 outlook met consensus for revenue growth but fell short on margins," said Samana in a research note cited by TheFly.

The company said it expects gross profit to grow at a low-twenties percentage rate.

Jefferies described the fourth-quarter results as “healthy” but noted Shopify continues a “trend of conservatism on margins.”

The brokerage maintained a ‘Hold’ rating on the stock with a $110 price target, noting that Shopify’s gross merchandise volume (GMV) of $94.5 billion and total revenue of $2.81 billion both exceeded estimates.

The company also reported operating margins of 16.5%, which Samana attributed to revenue upside and cost controls.

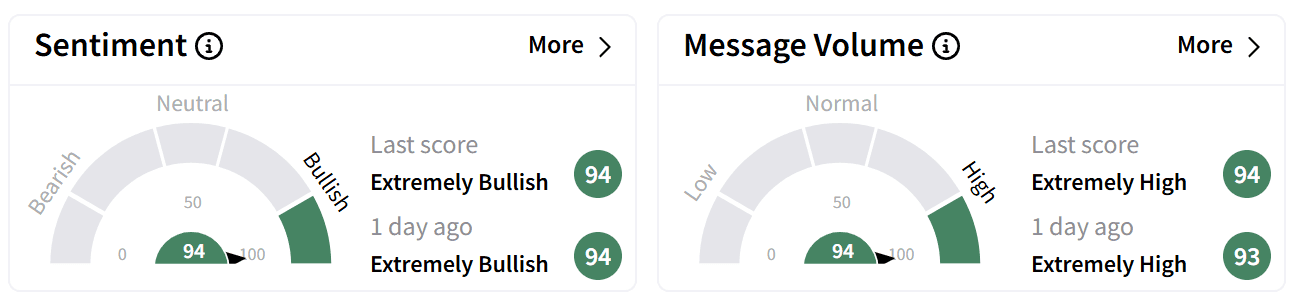

Despite the pullback, retail sentiment on Stocktwits around Shopify hit year-highs in the ‘extremely bullish’ zone accompanied by ‘extremely high’ chatter.

Users on the platform celebrated the company’s earnings, calling the market reaction “irrational.”

Shopify's stock is currently trading 6% below its 52-week high but has gained 10.8% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read also: Atomera Stock Rises Ahead of Q4 Earnings As Retail Awaits Strategy Updates

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)