Advertisement|Remove ads.

Shyam Metalics Breakout Watch: SEBI RAs Say Expansion Plans, Fundraise Could Fuel Next Leg Of Rally

Shyam Metalics & Energy is capturing attention after an 8% run over the last five days, and technical signals suggest a strong possibility of a breakout ahead.

The stock was trading 2.6% higher at ₹920 at the time of writing on Thursday.

Technical Outlook

According to SEBI-registered analyst Front Wave Research, Shyam Metalics’ shares are exhibiting strength across multiple timeframes, signaling a strong bullish trend.

With the price action supported by sector tailwinds and visible growth triggers, the stock looks well-positioned for a potential breakout, they said. By October 20, the stock could reach a target price of ₹1,146, according to the analyst.

Analyst Sameer Pande noted that the stock has given a positive breakout on the supertrend indicator, with the relative strength index (RSI) hovering near 67. This level reflects strong buying interest with further upside potential.

Shyam Metalics is also trading above both the volume-weighted average price (VWAP) and the 20-day exponential moving average (EMA), which reinforces its short-term strength, the analyst noted.

On the monthly chart, the stock is approaching a key supply zone near ₹930. With buoyant investor sentiment and momentum on its side, a breakout beyond this resistance zone looks increasingly likely, Pande said.

Traders should watch for a closing stop-loss at ₹840 to manage downside risk, he added.

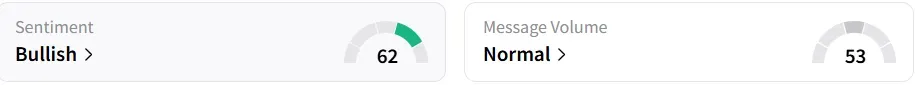

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a day earlier.

Fundamentals boosted by diversification

Shyam Metalics is expanding its business by venturing into the railway sector. It has invested ₹450 crore in a wagon manufacturing plant in Kharagpur with a planned capacity of 4,800 wagons per year. Commercial operations are expected to begin by FY27.

The company has also established an aggressive capital expenditure (capex) pipeline across ferro alloys, aluminium foils, and energy, aimed at driving capacity-led growth over the next five years.

The board is scheduled to meet on July 22 to consider a fundraising effort to drive the expansion.

Backed by a near-zero debt profile, strong return ratios, and policy tailwinds such as the government’s focus on logistics, rail infrastructure, and the Make in India scheme, Shyam Metalics offers a compelling long-term prospect.

Year-to-date, the stock has benefited from strong buying interest, gaining more than 27%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)