Advertisement|Remove ads.

SLB, Apple, Nvidia, Merck, Gilead Sciences: What Sparked Heavy After-Hours Trading In These 5 Stocks?

U.S. stocks closed Wednesday’s session mixed, with the broader S&P 500 Index and the Nasdaq Composite hitting fresh highs, while the Dow Jones Industrial Average retreated.

Although the tame producer price inflation report generated some strength in the market in the morning session, the perils of trading an overbought market made traders cautious as the session progressed.

The following stocks saw the biggest volume surge in extended trading, even as the market turns its attention to the August consumer price inflation CPI) report due on Thursday:

SLB Ltd. (SLB)

After-hours move: 0.14%

Trading volume: 5.86 million

Oilfield services company SLB remained on investors’ radar despite the lack of any significant news. The Houston, Texas-based company’s shares rose over 1% on Wednesday, outperforming the broader market, after crude oil futures climbed 1.7% during the session.

The stock, however, is down 3.5% for the year-to-date period.

On Stocktwits, retail sentiment toward SLB stock remained ‘neutral’ (51/100) by late Wednesday, and the message volume also stayed ‘normal.’

Apple, Inc. (APPL)

After-hours move: +0.10%

Trading volume: 4.67 million

Apple’s stock tumbled over 3% on Wednesday, even as the broader market managed to close in the green. The drop came despite the stock snagging a slew of price target hikes from Wall Street firms following the “Awe Dropping” hardware launch event held on Tuesday.

BofA, Rosenblatt, Melius Research and Evercore ISI were among the firms that upped their price targets for Apple’s stock, with the updated estimates from these firms ranging from $241 to $290, the Fly reported. JPMorgan and Citi said the launch event was aligned with their expectations, while Morgan Stanley said it was slightly more awe-dropping than expectations.

Apple stock is down about 9.1% year-to-date (YTD).

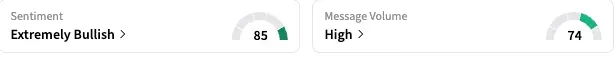

Retail sentiment toward the stock remained ‘extremely bullish’ (85/100), and the message volume was ‘extremely high.’

Nvidia Corp. (NVDA)

After-hours move: -0.10%

Trading volume: 4.21 million

Nvidia rode on the back of Oracle's (ORCL) exuberance and ended Wednesday’s session up nearly 5% at $177.33, although it was off its all-time intraday high of $184.48. However, retail interest is on the wane. On Stocktwits, retail sentiment toward Nvidia stock remained ‘bearish’ (37/100). The message volume on the stream was ‘low’ relative to historical norms.

The shares of the artificial intelligence chipmaker are up more than 32% this year.

Merck & Co. (MRK)

After-hours move: +0.10%

Trading volume: 3.91 million

Pharma giant Merck has come onto investors’ radar as it declined on Wednesday, aligning with the pullback in the healthcare stocks in the afternoon. The S&P 500 Healthcare Index fell 0.91% on Wednesday.

The company also abandoned plans to build a research center in the U.K., citing the “challenges of the UK not making meaningful progress towards addressing the lack of investment in the life science industry and the overall undervaluation of innovative medicines and vaccines by successive UK governments,” the London Times reported.

Merck stock, which has fallen nearly 14% this year, elicited ‘bearish’ sentiment (42/100) from among users on Stocktwits. The message volume was at ‘normal’ levels.

Gilead Sciences, Inc. (GILD)

After-hours move: +0.65%

Trading volume: 3.57 million

Gildead Sciences was in the news on Wednesday as RBC Capital Markets named the company as one of the beneficiaries of Health and Human Services (HHS) Secretary and prominent antivaxxer Robert Kennedy's potential departure from the agency. The firm said healthcare could be viewed as "less unpredictable" and "more investable" if the secretary were to depart his position, according to the Fly.

Kennedy has been under pressure from HHS employees, both former and current, to quit, as they alleged that he has put the health of America at risk with his actions, which include cancelling emergency use authorizations for COVID-19 vaccines without providing data or methods to justify the decision.

Retail sentiment toward the Gilead Sciences stock remained ‘neutral’ (47/100). and the message volume also stayed at ‘normal’ levels.

The stock has gained 26.5% YTD.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)