Advertisement|Remove ads.

Smithfield Foods Earns Multiple 'Buy' Calls On Protein Demand Boom, But Retail Yet To Buy In

Shares of Smithfield Foods Inc. (SFD) were in the spotlight on Friday as the packaged meats-focused company received ‘buy’ ratings from several Wall Street analysts, but retail sentiment stayed cautious.

Citi initiated coverage of Smithfield Foods with a ‘Buy’ rating and $27 price target that represented a 28% upside from current levels, The Fly reported.

According to the research firm, margin expansion in its packaged meats segment exceeds that seen by its peers. According to the firm, it has further potential to drive profit higher in the coming years, including from share gains in deli and lunchmeats and more stable hog production profit.

BofA analyst Peter Galbo also initiated coverage of Smithfield Foods with a ‘Buy’ rating and $28 price target.

According to the firm, consumers continue to seek protein rich diets that stand to favor Smithfield's offerings, particularly pork. It noted that Smithfield is the largest vertically integrated U.S. hog producer and fresh pork processor.

Goldman Sachs analyst Leah Jordan began coverage with a ‘Buy’ rating and a $32 price target. According to the firm, Smithfield has a "solid growth story" given the company's "industry-leading" packaged meats portfolio.

According to Jordan, Smithfield has a compelling total return profile with earnings growth and a 5.5% dividend yield. The firm expects consumers to look for value-added options for convenience and flavor diversity. It also sees an "outsized earnings lift" for Smithfield in the near-term due to a cyclical recovery in hog production with lower feed costs.

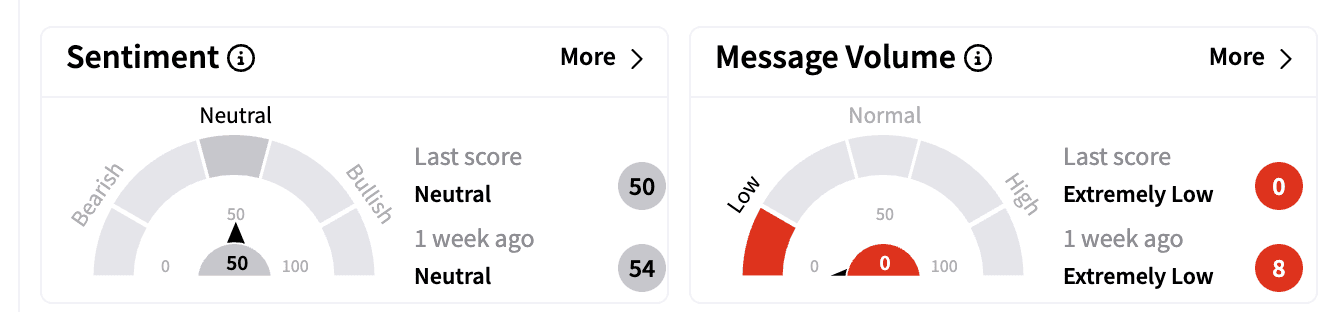

Retail sentiment on Stocktwits remained ‘neutral’ compared to a week ago. Message volume was in the ‘extremely low’ zone.

Last month, Smithfield priced its initial public offering of 26,086,958 shares at a price of $20 per share.

Smithfield Foods focuses on packaged meats and fresh pork products.

Smithfield Foods stock is up 6.9% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2197860201_jpg_c4f2083335.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)