Advertisement|Remove ads.

SMX Stock Sparks Retail Buzz After Elimination Of Convertible Debt

- SMX completed the conversion of $20.6 million in convertible notes into about 1.23 million ordinary shares.

- Earlier this week, the company said it has enough funding to operate into early 2026 and is concentrating on growing its Plastic Cycle Token.

- On January 2, the company said it is adding latex and rubber glove tracking to its platform, focusing on a large and difficult rubber waste.

SMX PLC (SMX) announced on Thursday that it has completed the full conversion of $20.6 million in convertible notes issued in December 2025 into about 1.23 million ordinary shares.

The company said the conversion provides a clearer path for executing its technology roadmap without the constraints of prior financing instruments.

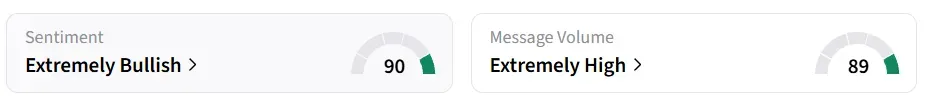

Despite the firm’s optimism, shares of the company declined nearly 4% on Thursday morning. On Stocktwits, retail sentiment around the stock changed to ‘extremely bullish’ from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

Stocktwits users sounded optimistic about the stock.

Advancing Material-Embedded Identity Technology

SMX’s platform embeds molecular markers directly into physical materials during manufacturing, creating persistent, tamper-resistant identities. Unlike traditional labels or barcodes that can be removed or lost, this technology ensures the material itself carries verifiable data throughout its lifecycle,

This enables authentication, regulatory compliance, lifecycle traceability, and support for circular recovery programs.

Earlier this week, the company said it has enough funding to operate into early 2026 and is concentrating on growing its Plastic Cycle Token. The company is investing in expanding its material marking and verification tools, improving its digital systems, and increasing the adoption of its technology across global supply chains.

On January 2, the company said it is adding latex and rubber glove tracking to its platform, focusing on a large and difficult rubber waste problem. The firm plans to track gloves from factory to disposal, embedding its invisible molecular markers into the gloves during production.

SMX stock has declined by over 99% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236271712_jpg_16001d2299.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Figma_jpg_4536c33786.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)