Advertisement|Remove ads.

SNAP Gets Caught Up In Tech Rout, Stock Posts Worst Day In 6 Months

- Snap reported fourth-quarter revenue that surpassed targets, although its Q1 forecast came in slightly below.

- On Thursday, the market fell, led by declines in tech stocks such as Microsoft, amid AI-spending fears and a weak labour market report.

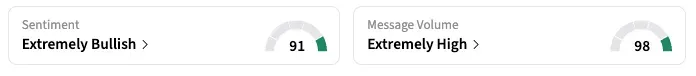

- Even as Snap stock has lost a third of its value in the past week, Stocktwits sentiment continues to track ‘extremely bullish.’

Snap, Inc. became an unfortunate victim in a tech rout sparked by concerns over the sector’s high spending and AI-driven disruption.

Despite posting upbeat results late Wednesday, Snap shares dropped 13.4% on Thursday – its steepest drop since last August. Including that, the stock has now lost about 33% of its value just in the last six sessions. To be sure, Snap’s first-quarter revenue forecast came in slightly shy of estimates.

Growth fears rattled Wall Street on Thursday, with signs of weakening in the labor market sparking another day of steep stock-market declines, even as eye-popping 2026 capital expenditure plans from Microsoft, Amazon, and their peers continued to sour investor sentiment.

The Nasdaq composite fell 1.6%, extending its worst rout since April’s tariff crash. The S&P 500 information-technology sector dropped 1.7%, weighed by a 5% drop in Microsoft and a 4.7% slide in Salesforce. Amazon dropped 11.2% in the after market session.

Analysts, Retail View

Snap’s drop came amid a string of positive commentary and price target upgrades from analysts.

Wells Fargo, which raised its SNAP price target by $2 to $10, said the company’s business mix was shifting more toward subscriptions, a positive amid stable ad growth. They believe Snap is taking the appropriate steps to improve core profitability.

B. Riley upgraded its target to ‘Buy’ from ‘Neutral’ and kept its price target unchanged at $10 – implying a 70% upside to the stock’s close on Wednesday.

Retail investors held their own. On Stocktwits, retail sentiment for SNAP remained ‘extremely bullish,’ unchanged since the company reported earnings.

“The forecast does not include revenue from the Perplexity integration, a $400 million deal announced last year,” said a bullish user. “It reported net income of $45 million in the fourth quarter, compared with $9 million a year earlier… This moment can be considered a turning point.”

Snap announced in November that it would integrate Perplexity’s AI-powered answer engine into Snapchat, with an earning potential of $400 million a year.

However, Snap’s $500 million buyback plan sparked confusion. A retail investor questioned whether the announcement was a repeat of the $500 million buyback announced in November or was it a fresh one. “Are they just basically scamming people into thinking they were launched twice?” this person posted.

Snap Earnings Recap

Snap’s fourth quarter revenue rose 10% to $1.72 billion, surpassing analysts’ estimates of $1.70 billion. Advertising sales rose 5% to $1.48 billion, driven by growth in direct-response advertising.

For the first quarter, Snap expects revenue of $1.5 billion to $1.53 billion, below the $1.55 billion analysts were projecting.

Snap shares are now down 38% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Apple Stock Is Bucking The Trillion-Dollar Tech Rout — But Caution Still Prevails On Retail Street

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)