Advertisement|Remove ads.

Snap Retail Traders Upbeat Even As Stock Slumps After Company Flags Tariff Headwinds, Skips Guidance

Snap, Inc. (SNAP) was among the top five trending stocks on Stocktwits early Wednesday, with retail optimism abounding despite a sharp sell-off in the after-hours session.

Following its quarterly print released Tuesday after the market close, Snap stock shed 14.41% to $7.78 in extended trading.

Santa Monica, California-based Snap reported a narrower loss and 14% year-over-year revenue (YoY) growth for the first quarter of the fiscal year 2025.

Among the main metrics:

- Loss per share: $0.08 vs. last year’s loss of $0.19/share

- Revenue: $1.36B vs. $13.45B consensus and $1.325B-$1.36B guidance

- Adjusted EBITDA: $140M vs. last year’s $46M and $40M-$70M guidance

CEO Evan Spiegel attributed the strong revenue growth to the progress the company made with its direct-response advertising solutions, continued momentum in driving performance for small and medium sized businesses,and the growth of Snapchat+ subscription business.

Snap noted that its daily active users (DAU) climbed 9% YoY to 460 million, slightly ahead of the 459-million guidance. My AI (artificial intelligence) DAU climbed 55% YoY.

The monthly active users (MAU) hit more than 900 million.

Snap said total active advertisers jumped 60% in the first quarter and SKAdNetwork reported app purchases climbed 30%.

The company generated free cash flow of $114.40 million, sharply higher than the $37.90 million in the year-ago quarter.

Snap did not provide revenue guidance for the quarter. “Given the uncertainty with respect to how macroeconomic conditions may evolve in the months ahead, and how this may impact advertising demand more broadly, we do not intend to share formal financial guidance for Q2,” it said in a letter to shareholders.

However, it guided second-quarter DAU to 468 million, thanks to improvement in ad platform and content engagement, driven by increased spending in machine learning (ML) and AI infrastructure.

CFO Derek Andersen said on the earnings call that the company has seen some headwinds to its topline growth so far this quarter, with a subset of advertisers stating that their spending has been impacted by changes to the de minimis exemption, according to Koyfin transcript.

The exemption that was in effect before tariffs kicked in allowed shipments valued under $800 (per person, per day) to enter the U.S. free of duty and taxes.

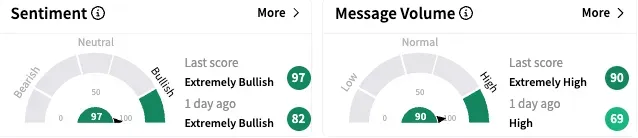

On Stocktwits, sentiment toward Snap stock stayed ‘extremely bullish’ (97/100), with the positivity improving after the release of the results. The message volume stayed ‘extremely high.’

A bullish user said Snap is a “bargain buy” and that they swooped up 10,000 shares.

Another user said the first-quarter report was the best in Snap’s history and expressed surprise at the stock reaction.

Snap shares have lost over 15% this year. The Koyfin-compiled consensus analysts’ price target is $11.01, implying 21% upside potential from Friday’s close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2221559761_jpg_71120b5aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_AT_and_T_store_resized_542005da9b.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_barr_OG_jpg_6005cfe225.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stocks_jpg_a3427ddfd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1900667440_jpg_c3b8e52a81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)