Advertisement|Remove ads.

Snap Stock Rises Premarket After Social-Media Company’s Q4 Beat: Retail Doubles Down

Shares of Snap, Inc. (SNAP) climbed in Wednesday’s premarket session following the Snapchat parent's forecast-beating fiscal year 2024 fourth-quarter results.

The social media company reported fourth-quarter non-GAAP earnings per share (EPS) of $0.16 compared to $0.08 a year ago and a consensus estimate of $0.14, according to Yahoo Fiance.

On a GAAP basis, the Santa Monica, California-based company reversed to a net income of $9 million from a loss of $248 million last year. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) improved to $276 million from $159 million.

Revenue climbed 14% year over year (YoY) to $1.56 billion, slightly beating the $1.55 billion consensus estimate.

Evan Spiegel, CEO of Snap, said, “In 2024 we made significant progress on our core priorities of growing our community and improving depth of engagement, driving top line revenue growth and diversifying our revenue sources, while building toward our long-term vision for augmented reality.”

Operating cash flow and free cash flow improved year over year to $231 million and $182 million, respectively, from $165 million and $111 million, respectively.

Among user metrics, daily active users (DAU) climbed 9% YoY to 453 million. The company said its direct response products and growth in small- and medium-size businesses contributed to more than doubling of total active advertisers.

CFO Derek Andersen said the company expects first-quarter revenue of $1.325 billion to $1.36 billion, assuming DAU will improve to 459 million, according to earnings call transcripts made available by Koyfin. This surrounded the consensus estimate of $1.35 billion.

He guided adjusted EBITDA to $45 million-$75 million.

The sell-side reaction was mixed, with Wells Fargo downgrading the stock to ‘Equal Weight’ from ‘Overweight’ and reducing the price target to $11 from $15, TheFly reported.

The brokerage attributed the action to its view the company’s app redesign is taking longer and its advertising growth remained stubbornly below industry levels.

On the other hand, BofA analyst Justin Post raised his price target to $14.50 from $14 and maintained a ‘Neutral’ rating. The analyst also hiked his revenue estimate for Snap, citing higher ad growth and Snapchat+ traction.

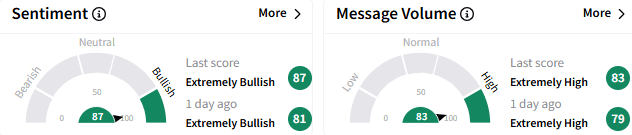

Snap was among the top five trending stocks on Stocktwits before the opening bell on Wednesday. Retail sentiment showed an ‘extremely bullish’ mood (87/100) and message volume stayed ‘extremely high.’

A user said a $16 price target is in the cards and that the company is undervalued

Another said they were piling into the stock.

Snap’s stock rose 1.20% to $11.74 in premarket trading. It has gained 7.70% so far this year, following a 36% slide in 2024.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243840626_jpg_6a78fa8844.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jeff_merkley_jpg_aca807f10f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)