Advertisement|Remove ads.

Solana Company Stock Plunges 40% After SOL Price Drop Hits Treasury Value

Shares of The Solana Company (HSDT) dropped as much as 40% in midday trade on Thursday after its treasury token, Solana (SOL), declined more than 5% over the past 24 hours amid broader weakness in the cryptocurrency market.

HSDT’s stock price fell to an intraday low of $8.65 before recovering to trade around $10 by early afternoon. However, retail sentiment around HSDT’s stock on Stocktwits improved to ‘neutral’ from ‘bearish’ territory.

Meanwhile, Solana’s price was trading at around $187, with retail sentiment continuing to trend in ‘bullish’ territory amid ‘high’ levels of chatter.

The company announced its pivot to a Solana-holding digital asset treasury (DAT) in late September and has since amassed over 2.2 million SOL tokens. The company has positioned its Solana holdings as part of a broader strategy to integrate blockchain infrastructure and on-chain financial management into its business model.

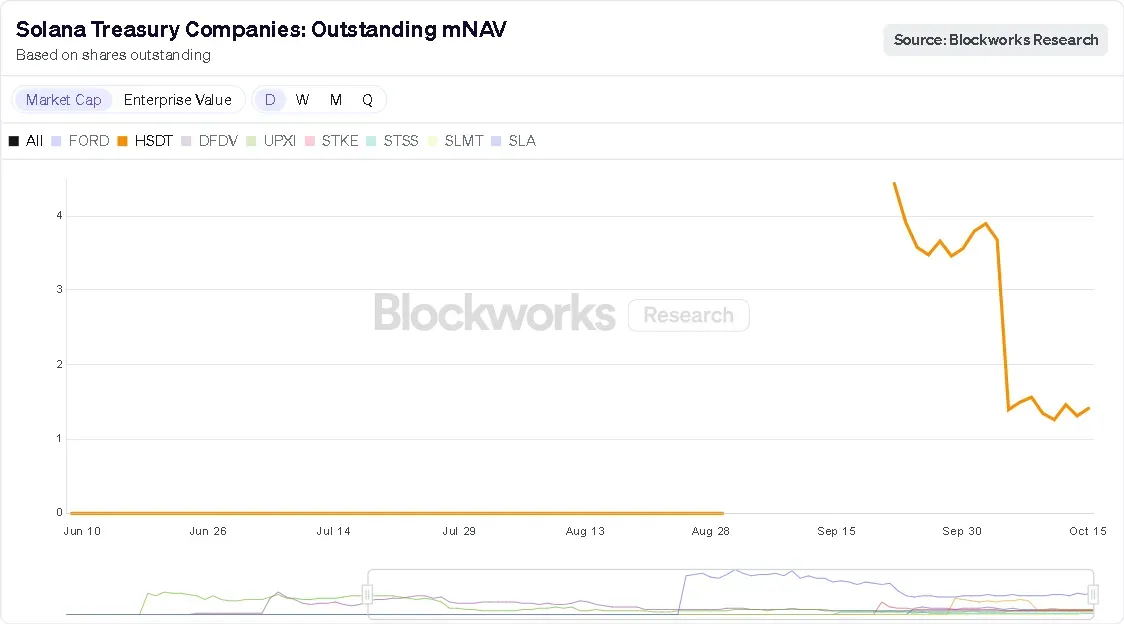

At its peak over the past week, Solana traded near $222, giving Solana Company’s holdings an estimated value of $488 million. Following the crypto market selloff that began Friday, the value of those holdings has fallen to about $413 million, as of the current trading price — a decline of roughly $75 million. In October, the company’s market net asset value (mNAV), dropped from 3.79 to 1.42, according to Blockworks data.

Other digital asset treasury firms were also in the red during afternoon trade amid the crypto sell-off. Tom Lee-backed Bitmine Immersion (BMNR) fell 3.2% as its native token, Ethereum (ETH), fell more than 2% in the last 24 hours. Similarly, Strategy (MSTR) fell 2.2% on Thursday as Bitcoin’s (BTC) price tumbled 2.1%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019709_jpg_f82a27a246.webp)