Advertisement|Remove ads.

Fed’s Raphael Bostic Reportedly Expects 2 Quarter-Point Rate Cuts This Year But Says Significant Uncertainty Exists

Atlanta Federal Reserve President Raphael Bostic reportedly said that he expects the central bank to make two quarter-point rate reductions this year, but there’s still a lot of uncertainty.

According to a Reuters report, Bostic told reporters on a call that two quarter-percentage-point rate cuts are his “baseline expectation.” "The uncertainty around that is pretty significant ... There's a lot that could happen that could influence that in both directions,” he added.

Although the Fed official said he doesn’t believe the U.S. might witness a fresh burst of inflation, he noted that businesses still have widespread apprehensions about how the new import taxes, immigration rules, and regulatory changes will impact the outlook.

"Taken as a whole, recent inflation data have supplied evidence for both optimism and pessimism,” he said.

Earlier this week, San Francisco Federal Reserve Bank President Mary Daly said the central bank should keep its policy restrictive until inflation improves.

"Policy needs to remain restrictive until ... I see that we are really continuing to make progress on inflation," Daly said at a community banking conference hosted by the American Bankers Association in Phoenix, Arizona.

Interestingly, Bank of America CEO Brian Moynihan said the Federal Reserve will unlikely cut rates this year as consumer spending remains strong.

“Our research team has taken all rate cuts off the table because they thought that the dynamics of the potential inflationary effect would cause the Fed to hold back,” he said.

The skeptical comments come in the wake of higher-than-expected inflation figures for January. According to the Bureau of Labor Statistics, the consumer price index (CPI) rose 0.5% on a seasonally adjusted basis in January, while the annual inflation rate rose 3%. According to a CNBC report, this compares with a Dow Jones estimate of 0.3% and 2.9%, respectively.

Core CPI, which excludes food and energy prices, rose 0.4% in January and increased 3.3% annually, versus estimates for 0.3% and 3.1%.

The recently released Fed minutes revealed that officials are willing to keep the rates on amid sticky inflation and economic policy uncertainties.

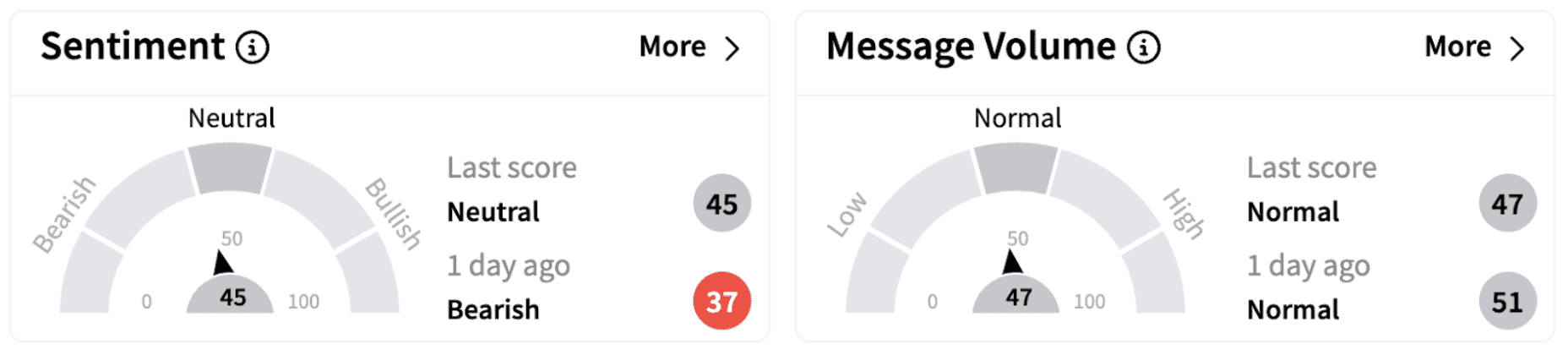

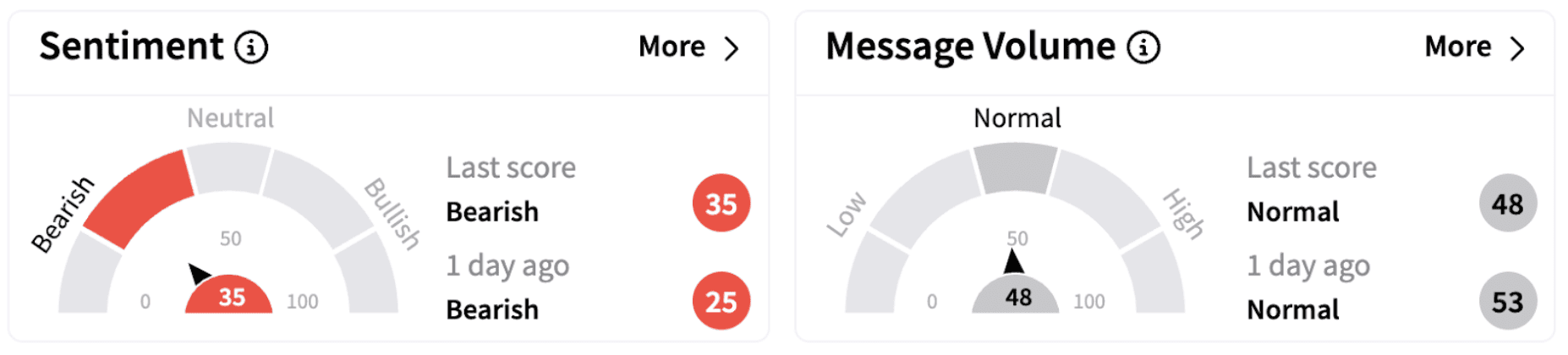

On Thursday, the SPDR S&P 500 ETF Trust (SPY) and the Invesco QQQ Trust, Series 1 (QQQ) traded in the red. Retail sentiment on Stocktwits toward these ETFs remained in the ‘neutral’ to ‘bearish’ territories.

According to the CME FedWatch tool, traders anticipate the next rate cut in July 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_natural_gas_plant_resized_jpg_e43db2dc7b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_JPM_resized_jpg_5def7e91d0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240044381_jpg_d366402b12.webp)