Advertisement|Remove ads.

SpaceX Competitor LandSpace Eyes $1 Billion IPO In China

- LandSpace is looking to raise 7.5 billion yuan ($1.07 billion), as per a release on SSE.

- Earlier this month, LandSpace became the first Chinese company to test a reusable rocket launch, competing with SpaceX.

- SpaceX is also eying an initial public offering in the U.S. in 2026 with a valuation of around $1.5 trillion.

China’s top private rocket startup, LandSpace, is eyeing a potential public listing on the Shanghai Stock Exchange (SSE) for 7.5 billion yuan ($1.07 billion).

The SpaceX competitor has submitted its application to list on the Chinese bourse, which the exchange accepted on Wednesday, according to a release on SSE’s website.

LandSpace’s plans to go public come even as SpaceX gears up for its own initial public offering (IPO) in the U.S. in 2026 with a blockbuster valuation of around $1.5 trillion.

Battle Of Reusable Rockets

Earlier this month, LandSpace became the first Chinese company to test a reusable rocket launch, and only the third in the world, after Elon Musk's SpaceX and Jeff Bezos' Blue Origin.

While the first LandSpace next-generation Zhuque-3 rocket test was unsuccessful, it advances China’s plans to launch a reusable orbital rocket that would rival SpaceX's Starlink. The rocket even garnered praise from Musk, who said in an X post that it could potentially beat Falcon 9, SpaceX’s reusable rocket.

Even as China is amping up its efforts to compete with the U.S. in space capabilities, SpaceX remains the leader in commercial rocket reusability, a capability it pioneered almost a decade ago.

SpaceX IPO

SpaceX is potentially looking at a U.S. listing in mid- to late 2026, possibly the biggest IPO in history. The company is reportedly looking to raise over $30 billion.

Musk seemingly confirmed the media speculation about its public offering on X earlier this month. The American space company’s revenue could reportedly touch $15 billion in 2025 and surge up to $24 billion in 2026.

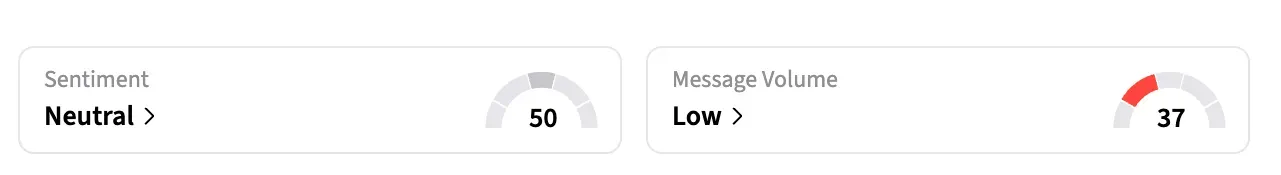

Meanwhile, on Stocktwits, retail sentiment for SpaceX was in the ‘neutral’ territory amid ‘low’ message volume at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

(1 Chinese Yuan = $0.14)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860610_jpg_2888fdef75.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novo_nordisk_ozempic_wegovy_jpg_786cdf3b34.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_brian_armstrong_coinbase_2_jpg_59a44ebea9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213364581_jpg_86d1ff954e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)