Advertisement|Remove ads.

Spirit Airlines Stock Plunges Pre-Market After WSJ Report Says Firm Exploring Bankruptcy Filing: Retail’s Frustrated

Shares of Spirit Airlines Inc (SAVE) nosedived over 36% in Friday’s pre-market session after The Wall Street Journal reported the airline is in talks with its bondholders for a potential bankruptcy filing after its failed merger with JetBlue Airways Corporation (JBLU).

According to the report, which cites anonymous sources, the firm is also considering a restructuring of its balance sheet via out-of-court settlements although discussions have been more inclined toward Chapter 11 filing.

A recent SEC filing shows that the company has entered into a letter agreement that modifies the existing card processing agreement to extend the 2025 Notes Extension Deadline from Sept. 20, 2024 to Oct. 21, 2024. By this date, the firm has to reach an agreement to extend or refinance its notes due in 2025 to maintain its partnership with U.S. Bank National Association.

Spirit Airlines has a long-term debt of $3.1 billion. The firm has also not recorded a net profit since the COVID-19 pandemic. Not surprisingly, the stock is down over 86% on a year-to-date basis before considering Friday’s decline.

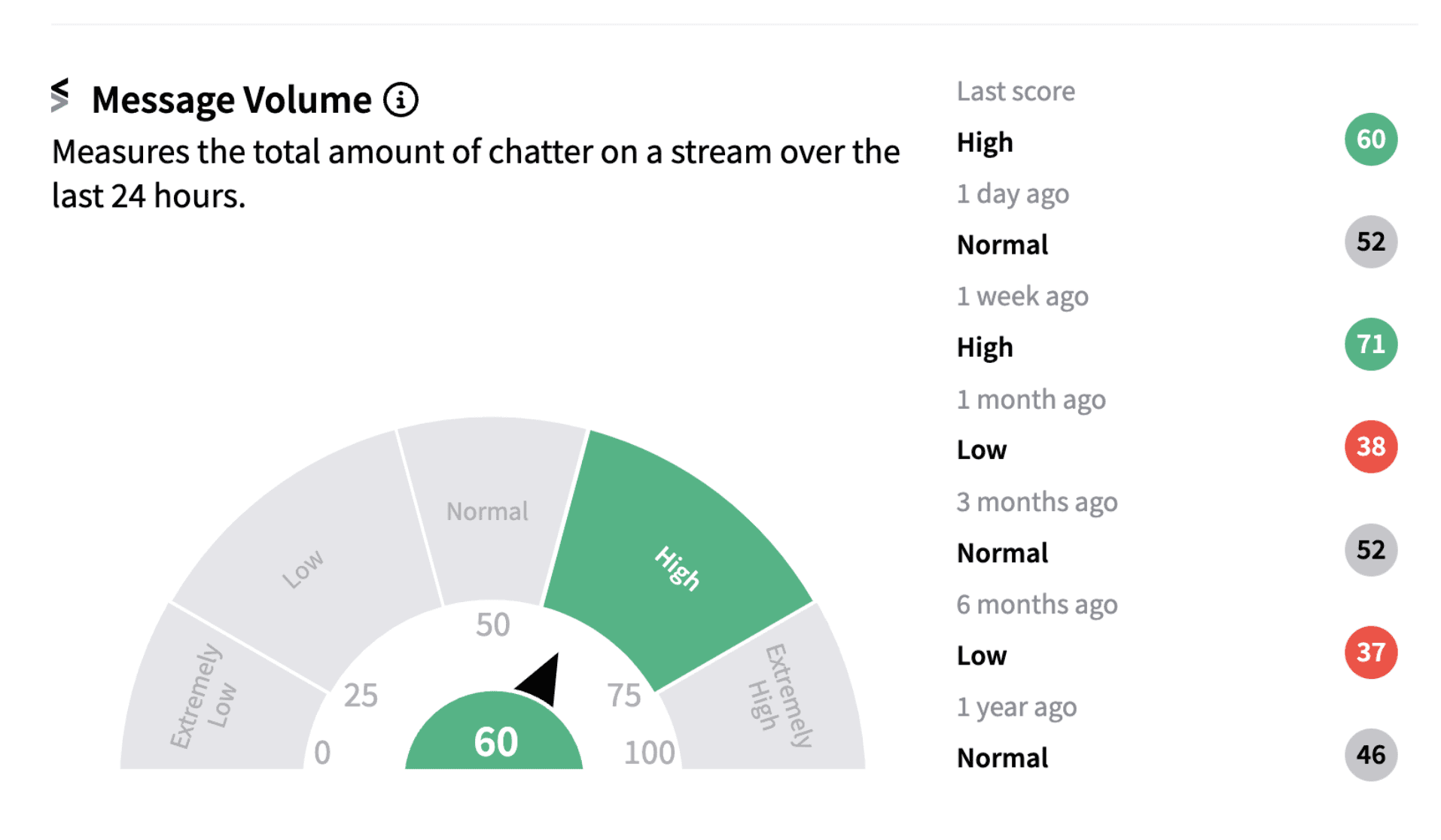

Following the announcement, message volumes on Stocktwits jumped into the ‘high’ territory (62/100) as retail investors began contemplating the airlines’ future.

Earlier this year, both JetBlue and Spirit Airlines called off their merger after a federal judge struck down the merger between the firms, supporting the Justice Department’s argument that the transaction would have impacted competition.

Spirit CEO Ted Christie said the firm was disappointed it could not move forward with a deal that ‘would save hundreds of millions for consumers and create a real challenger to the dominant "Big 4" U.S. airlines.’

Spirit had said that as part of the termination, JetBlue will pay the firm $69 million. While the merger agreement was in effect, Spirit stockholders received approximately $425 million in total prepayments.

Some Stocktwits users are still keeping hopes alive.

Others are expressing frustration over the failure of the merger.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)