Advertisement|Remove ads.

Spotify Strikes A Chord As Stock Jumps On Upbeat Q4 Forecast: Retail Tunes In Cheerfully

Shares of Swedish music streaming firm Spotify Technology ($SPOT) rose over 9% on Wednesday morning after the company’s fourth-quarter forecast topped Wall Street estimates.

Revenue rose 19% year-over-year (YoY) to €4 billion (~$4.25 billion) compared to an analyst estimate of €4.02 billion. Earnings per share stood at €1.45 versus an estimate of €1.72. Monthly active users grew 11% YoY to 640 million compared to an estimate of 639 million.

For the fourth quarter, Spotify expects monthly active users (MAU) to come in at 665 million against Wall Street’s expectations of 659.3 million, implying an addition of approximately 25 million net new MAUs in the quarter.

The firm expects to report operating income of €481 million, significantly higher than an analyst estimate of €432.7 million.

During the third quarter, the company’s premium revenue rose 21% YoY, driven by subscriber gains and average revenue per user (ARPU) increases. Meanwhile, ad-supported revenue grew 6% YoY.

The quarter also saw a significant improvement in gross margins by 473 basis points to 31.1%, with premium gains driven by music and audiobooks; and ad-supported gains driven by music and podcasts. The firm also reported a record free cash flow of €711 million during the quarter.

Notably, Spotify’s premium subscribers grew 12% YoY to 252 million during the quarter, up from 246 million last quarter and 1 million above guidance. The performance reflected growth across all regions, with outperformance led by Europe and Latin America.

Meanwhile, the stock has received multiple price target upgrades from brokerages. Morgan Stanley reportedly raised its price target on Spotify to $460 from $430, and kept an ‘Overweight’ rating on the shares.

JPMorgan hiked its price target on the stock to $530 from $425, and kept an ‘Overweight’ rating on the shares post the Q3 report.

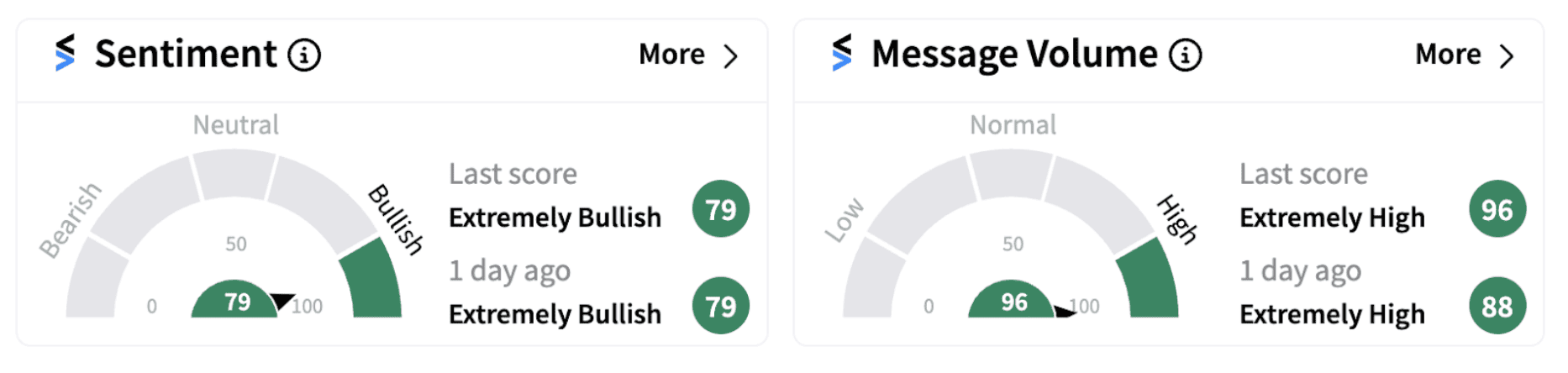

Following the earnings report, retail sentiment on Stocktwits continued to trend in the ‘extremely bullish’ territory (79/100), accompanied by extremely high retail chatter.

Some Stocktwits users are expressing bullish takes on the stock.

Also See: UBS Reportedly Upgrades 3M To Buy, Raises Price Target That Implies A Potential For Over 41% Rally

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)