Advertisement|Remove ads.

Starbucks CEO Says Investors Showed ‘Lot Of Interest’ In China Business Stake Sale: Retail View Strengthens

Starbucks (SBUX) has received "a lot of interest" from investors in talks to acquire a stake or partner for the company's China business, Brian Niccol told the Financial Times in an interview.

Niccol's comments are the company's first admission that it is exploring the sale of a minority stake in its China unit.

Shares rose 4.3% to $95.39 on Wednesday, and Starbucks was the second-best performer on the S&P 500 (SPY).

Starbucks first opened a cafe in China in 1999. The number has grown to 7,758, and China is currently the second-biggest market for the U.S. coffee chain.

“People see the value of the Starbucks brand. They see the coffee category is growing. I think they’d love to be partnering up with us in figuring out how we take this from 8,000 to 20,000 [stores],” Niccol said.

Starbucks’ revenue from China has fallen from $3.7 billion in 2021 to $3 billion in 2024, despite opening hundreds of new stores.

The decline comes amid rising competition from lower-priced local brands like Luckin and Cotti and broader concerns about consumer spending in a slower economy.

Earlier this week, Starbucks cut prices on some of its beverages in China.

The plan to offload a stake in the business is part of a business revival strategy under Niccol, who took over as CEO in October last year.

Starbucks has eliminated over 1,000 jobs and is implementing a strategic overhaul that includes redesigning store layouts and integrating technology into barista workflows.

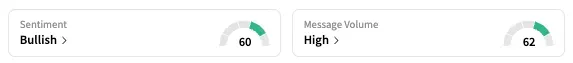

On Stocktwits, the retail sentiment for the company shifted to 'bullish' from 'neutral.'

A user said Starbucks stock could rise to $100 by the end of the week.

On Wednesday, Goldman Sachs raised its price target on the shares to $95 from $85, while maintaining its ‘neutral’ rating, over what it believes is increased clarity over the company’s turnaround strategy.

Starbucks shares are up 4.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2213245133_jpg_7b8ad24799.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carvana_jpg_86121a5fd5.webp)