Advertisement|Remove ads.

Steel Dynamics Stock Gains Pre-Market As Morgan Stanley’s Bullish Call On Tariff-Driven Gains Spurs Retail Interest

Steel Dynamics (STLD) shares climbed more than 2% in pre-market trading on Friday after Morgan Stanley upgraded the stock to ‘Overweight’ from ‘Equalweight’ and raised its price target to $158 from $145.

Steel prices are up in reaction to U.S. tariff policy, the analyst told investors in a research note reported by TheFly.

While President Donald Trump recently paused tariffs on several imports from Mexico and Canada, his administration had previously imposed a 25% tariff on nearly all imports from both countries.

Additional steel and aluminum tariffs are still set to take effect on March 12, the President confirmed on Thursday at a press conference.

While Morgan Stanley raised its 2025 steel price forecasts, it warned of a potential pullback in the second half of the year due to a "tempered steel demand outlook and widening import arbitrage."

Still, the brokerage sees Steel Dynamics as well-positioned for gains, noting that the company’s capital expenditure cycle is nearing completion, which should free up cash flow and increase shareholder returns.

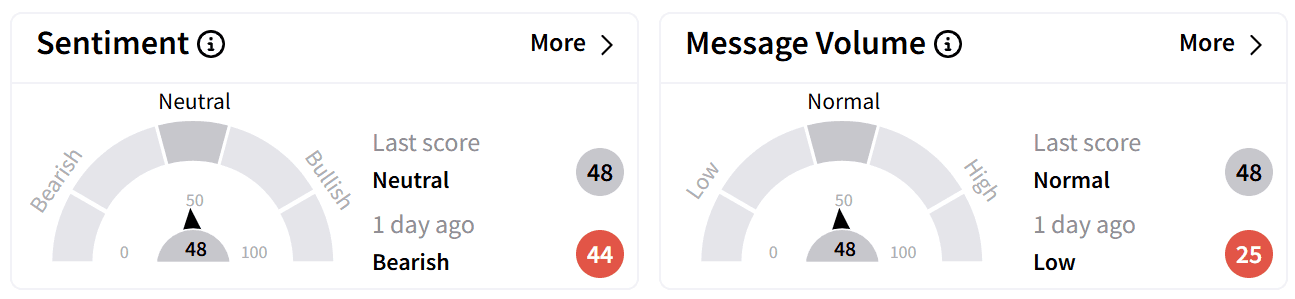

On Stocktwits, retail sentiment around Steel Dynamic’s stock improved to ‘neutral’ territory from ‘bearish’ a day ago. The move was accompanied by a slight increase in retail chatter.

Steel Dynamics stock remains down 4% over the past year but has gained 8% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Intuit_resized_jpg_913ef93c15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_oil_rig_bfbf070c8b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_micahel_saylor_OG_3_jpg_4f304c479d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1473343393_1_jpg_536dff4c41.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247675651_jpg_f78879cce2.webp)