Advertisement|Remove ads.

Stellantis Stock Logs Worst Drop In 2 Months After Q4 Print, But Retail Feels Profit Crash Was Already Baked In

Stellantis N.V.’s U.S.-listed shares tumbled over 5% on Wednesday, marking their worst single-day decline since Dec. 16, after the automaker posted a steep 70% annual profit drop.

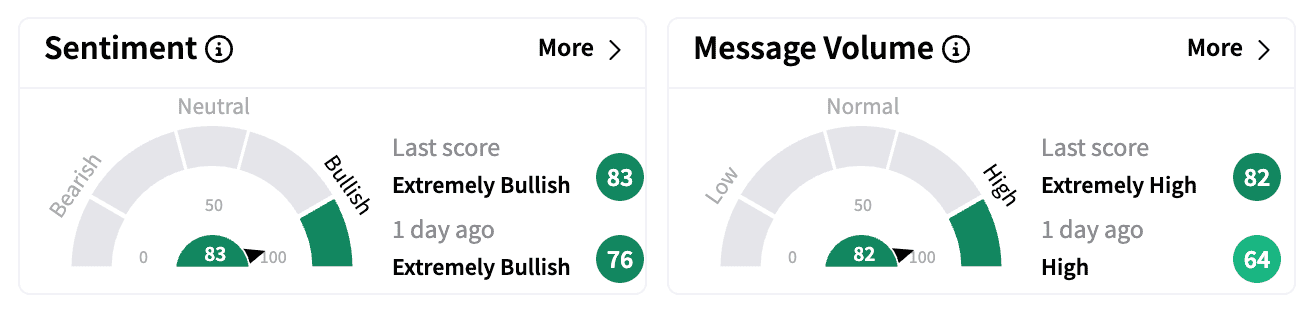

Despite the weak earnings, retail sentiment on Stocktwits remained 'extremely bullish,' with many investors saying the decline was already priced in.

The company reported a full-year 2024 net profit of €5.47 billion ($5.72 billion), down from €18.6 billion a year earlier, with EPS falling to €1.84 from €5.94.

Net revenue also slid to €156.88 billion from €189.54 billion, slightly exceeding analyst estimates of €156.18 billion.

Stellantis' board proposed an interim dividend of €0.68 per share, payable May 5 to shareholders on record as of April 23, a sharp cut from last year's €1.55 per share payout.

The company expects positive net revenue growth in 2025 but provided no detailed guidance.

Investor discussions on Stocktwits reflected a more optimistic tone. Message volume on the platform surged 183% as traders debated the company's outlook.

One bullish user predicted the stock would bounce back into the $45-$60 range, while another pointed to the company's forward-looking statements and expectations for revenue growth as reasons for optimism.

Beyond earnings, investors are eyeing the looming 25% U.S. tariffs on Mexico and Canada, which are expected to kick in next month under President Donald Trump's trade policies.

With 23% of Stellantis' U.S. sales coming from Mexico-produced cars — more than GM (22%) and Ford (15%) — its supply chain faces significant risks.

Adding to the uncertainty, Stellantis is in a leadership crisis following the abrupt December exit of CEO Carlos Tavares, who left due to "different views" with the board.

Despite Wednesday's drop, Stellantis shares are up 1.8% year-to-date. According to Koyfin data, of 27 analysts covering the stock, 15 rate it 'hold', 11 have 'buy' or 'strong buy' ratings, and one analyst rates it 'sell.’

(1 EUR = 1.05 USD)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1236199359_jpg_28b0018e3a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199401088_jpg_656c1eacd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_wall_street_sign_resized_f75f6c0a63.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_e90331e6a6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2210921290_jpg_46bb1e6211.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_figma_original_jpg_90603f536b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)