Advertisement|Remove ads.

These Three Stocks Witnessed The Greatest Change In Watchers Over The Last Week

Major US equity indices have been hitting record highs recently, led by rate cut optimism due to weak economic data. However, a churn has also been observed from the mega-cap stocks to the small-cap universe. At this crossroads, let’s take a look at some of the stocks that witnessed a significant jump in watchers over a one-week period.

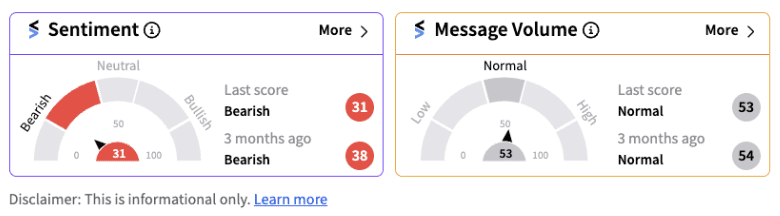

1. Trump Media & Technology Group Corp: The number of watchers for the stock rose by 3,373 from last week. Shares of the firm, which is majority-owned by former President Donald Trump, have been gaining traction in recent days after a failed assassination attempt on the Republican candidate. The stock has gained nearly 25% in the last five days itself given that perceived chances of Trump’s re-election have increased significantly in the wake of the attack. Retail sentiment, however, is trending in bearish territory.

2. NVIDIA Corp: The chip-maker witnessed 1,860 more watchers tracking the stock since last week. Shares of the firm fell over 6% on Wednesday, in line with other chip stocks, after a report indicated that the Biden administration may be considering tougher restrictions on China’s access to chip technology. Retail sentiment remained in the neutral zone (54/100) for the stock. Meanwhile, Donald Trump’s remarks on Taiwan, in which he stated the country should pay the U.S. for its defense, also did not bode well for chip stocks.

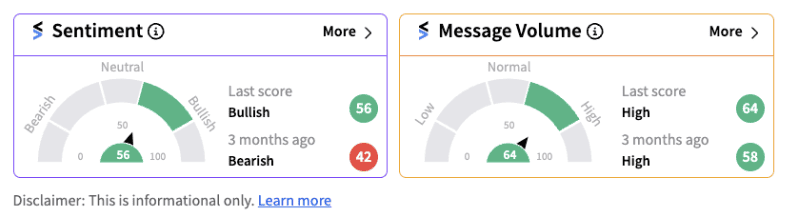

3. Maxeon Solar Technologies: The stock witnessed an additional 1,514 watchers in the last seven days. Shares of the Singapore-based photovoltaic panel manufacturer were down nearly 4% on Wednesday. On a year-to-date basis, the stock has lost over 96% of its value. Recently, Mizuho reportedly cut its price target on the stock to $0.20 from $4 earlier while maintaining a ‘Neutral’ rating. According to a report, Maxeon Solar had secured new financing last month and expects a cash infusion in the second half of the year. It said this anticipated dilution led to the adjustment in the price target. Retail sentiment on the stock was trending in the bullish territory (56/100) as of midday Wednesday.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2207639540_jpg_4ae2641504.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Gold_Silver_jpg_c77de4fb71.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_hassett_jpg_1eb8c227c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Draft_Kings_jpg_c77a08f48a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)