Advertisement|Remove ads.

Stratasys Stock Declines Pre-Market As 2025 Guidance Fails To Meet Wall Street Expectations: Retail’s On The Fence

Shares of Stratasys Inc. (SSYS) declined over 3% in Wednesday’s pre-market session after the company’s 2025 guidance fell short of Wall Street's expectations.

Revenue declined 4% year over year (YoY) to $150.36 million but beat a Wall Street estimate of $149.97 million, per Koyfin data. The company reported adjusted earnings per share (EPS) of $0.12, marginally topping an analyst estimate of $0.10.

For 2025, Stratasys expects revenue of $570 million to $585 million, lower than a Street estimate of $585.86 million. The company projected an adjusted EPS of $0.28 to $0.35 versus a Street estimate of $0.36.

The company also guided for adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) of $44 million to $50 million, reflecting an adjusted EBITDA margin of 7.8% to 8.5%. Capital expenditures are expected to be $25 million to $30 million.

CEO Yoav Zeif said that continuing strong customer engagement reaffirmed the company’s expectations that once spending constraints ease, adoption rates will accelerate, and the firm will return to growth and generate increased profits.

“Our healthy balance sheet of $150.7 million in cash, cash equivalents, and short-term deposits, with no debt, provides stability and optionality to support our growth. We look forward to closing the $120 million investment from Fortissimo Capital that will further bolster our already robust position to help drive our future growth,” he said.

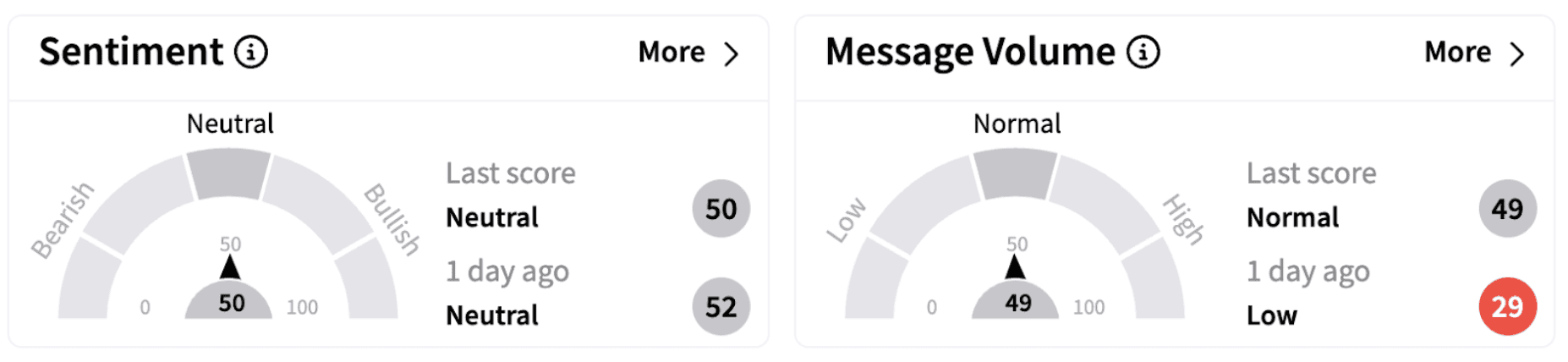

On Stocktwits, retail sentiment continued to trend in the ‘neutral’ territory on Wednesday morning.

Recently, Cantor Fitzgerald raised its price target on Stratasys to $15 from $12 while keeping an ‘Overweight’ rating ahead of the Q4 results, according to TheFly.

SSYS stock has gained 22% in 2025 but lost over 9% over the past year.

Also See: KKR To Sell Stake In Japanese Supermarket Chain Seiyu To Trial Holdings: Retail Optimism Rises

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Black_Rock_Bitcoin_ETF_IBIT_f66b744bfc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kraken_2091850a33.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215666275_jpg_07d03239b9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_2_jpg_a7bbca2bde.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)