Advertisement|Remove ads.

KKR To Sell Stake In Japanese Supermarket Chain Seiyu To Trial Holdings: Retail Optimism Rises

KKR & Co. Inc. (KKR) said on Wednesday it will sell its stake in the Japanese distribution and retail business operator Seiyu to Trial Holdings, Inc., representing a “significant outcome” for the private equity giant.

KKR acquired a 65% majority stake in Seiyu from Walmart in 2021 and then bought an additional 20% stake from Rakuten in 2023, taking its total shareholding to 85%. The investments were made from the company’s Asian Fund IV.

The private equity firm said that Walmart will also sell its 15% stake to Trial under the deal.

Seiyu CEO Tsuneo Okubo said that over the past few years, the company has leveled up its merchandising strategies and in-store operational capabilities while reinvesting in stores, employees, and IT capabilities.

“We now look forward to building on this success with the support of our new shareholder Trial in Seiyu’s next chapter,” Okubo said.

Trial Holdings is looking to finance the transaction through its cash on hand and new bank borrowings. “While this transaction will result in increased borrowings, we project the leverage metrics to normalize to retail sector average in the medium term,” the company said.

Trial Holdings also clarified that it does not plan to raise funds through a new share issuance (equity financing) in connection with the transaction.

KKR has been in the news lately since the firm completed the second stage of its tender offer for the Japanese system integration company Fujisoft. KKR now owns nearly 58% of the firm, becoming its largest shareholder.

The private equity firm received tenders in excess of 19.25%, the minimum ownership stake required to conduct a squeeze-out. The deal is valued at approximately $4.4 billion.

KKR recently announced it will acquire an additional 5% stake in Enilive from Eni for €587.5 million ($614.75 million). The additional stake purchase will increase KKR’s total holding in Enilive to 30%.

Enilive, Eni’s mobility transformation company, is involved in biorefining, biomethane production, smart mobility solutions, and providing services to support people on the move.

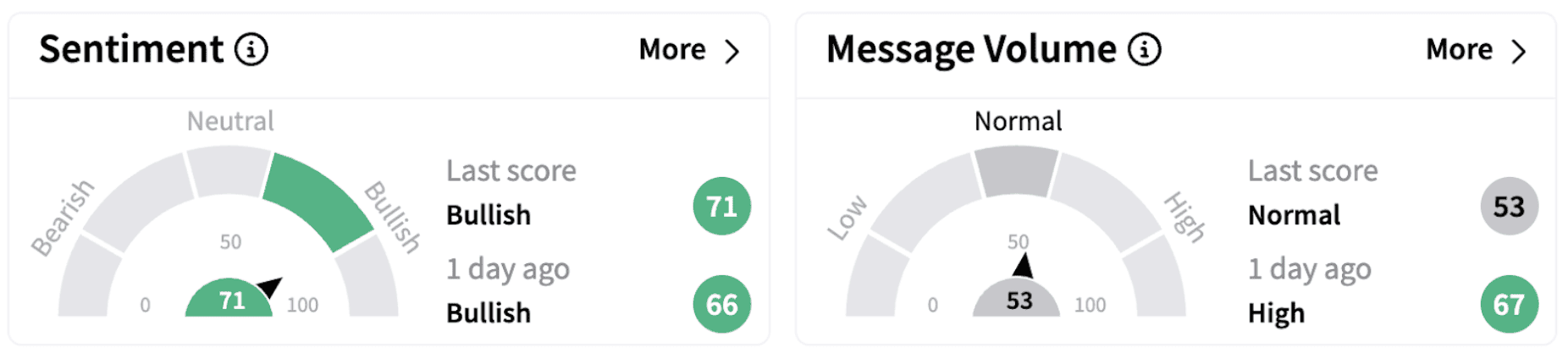

Meanwhile, retail sentiment on Stocktwits climbed further into the ‘bullish’ territory (71/100) on Wednesday morning.

KKR shares traded 1% higher in Wednesday’s pre-market session. The stock has lost over 19% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_American_Airlines_Getty_4d3d704837.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sabre_resized_jpg_fa5aa35db6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2049107660_jpg_906b4acd1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203496924_jpg_18e024f0e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2195819624_jpg_841341254c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_72608012_jpg_3da2f4e2a2.webp)