Advertisement|Remove ads.

Super Micro Stock In Reverse Gear Ahead Of Q2 Business Update: Retail Sees Dip As Last Opportunity Before Liftoff

Shares of Super Micro Computer, Inc. (SMCI) retreated in Tuesday’s premarket trading as the artificial intelligence (AI) server maker prepared to provide its second-quarter business update.

The stock was up a solid 17.56% on Monday and it went past the $40 barrier, settling the session at a one-month high of $42.65. The upside was accompanied by above-average volume, which lent credence to the move.

Super Micro’s scheduling of the second-quarter update on Feb. 3 proved healthy for the stock. Investors took that as a cue that the company’s new auditor, BDO, did not find any serious accounting issues to stall an update.

The stock gathered further momentum after it announced the full production availability of its end-to-end AI data center building block solutions powered by Nvidia Corp. (NVDA) Blackwell platform.

Super Micro stock, which rallied to as high as $122.90 in March 2024 amid the AI euphoria, came under pressure due to multiple headwinds. The company’s then auditor Ernst & Young, resigned, citing concerns about accounting practices and internal controls.

The company also delayed the filing of its fiscal year 2024 financial reports on Form 10-K and the fiscal year 2025 first-quarter report on Form 10-Q in a timely manner. This prompted the receipt of a Nasdaq deficiency letter and worries concerning potential delisting.

As a result, the stock price tumbled and Super Micro was booted out of the Nasdaq 100 Index.

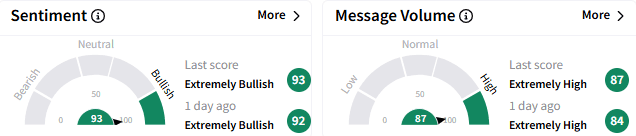

On Stocktwits, retail sentiment remains ‘extremely bullish’ (93/100), reflecting expectations that the worst may be behind. Retail chatter also continued unabated ahead of the report, perking up message volume to ‘extremely high’ levels.

It is the top trending and most active stock on the platform early Tuesday

Analysts, on average, expect Super Micro to report second-quarter earnings per share (EPS) of $0.61, up from $0.56 a year ago, according to Yahoo Finance data. Revenue is estimated to have risen 57.50% year-over-year (YoY) to $5.77 billion.

Investors may be keen to get an update on whether the company can meet the Feb. 25 SEC deadline to regain compliance.

A retailer watcher recommended buying the dip before the stock takes off.

Another pointed to institutional buying and looked forward to the stock topping the $60 levels following the business update.

In premarket trading, Super Micro stock fell 5.46% to $40.32, although it has gained about 40% so far this year.

CFRA upgraded Super Micro shares to ‘Buy’ from ‘Hold’ with a $48 price target in a report released late Monday, according to The Fly. The firm expects near-term margin recovery to the mid-teens level and market share gains, given the company’s proven rapid development capabilities and expanding product portfolio,

Super Micro’s dominant position in liquid cooling and advantage with Nvidia’s Blackwell B200 rack solutions showcases its AI infrastructure leadership, it added.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Cyngn Stock Gains Momentum, Eyes Break Above $0.25: Retail Traders Saw It Coming

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)