Advertisement|Remove ads.

Supernus Pharmaceuticals Gets Retail Excited Over $795M Acquisition Plan For Sage Therapeutics

Supernus Pharmaceuticals, Inc. (SUPN) on Monday announced its intent to acquire Sage Therapeutics, Inc. (SAGE) for up to $795 million. SAGE stock traded 34% higher on Monday morning following the announcement.

Under the terms of the deal, Supernus intends to acquire Sage for a total consideration of $12 per share in cash, including $8.50 per share payable at closing and a contingent value right (CVR) worth up to $3.50 per share in cash. The CVR is payable upon achieving certain net sales and commercial milestones, the companies said.

The total consideration represents a premium of about 79% from SAGE’s closing price of $6.7 on Friday.

The transaction is expected to close in the third quarter of 2025 and strengthen Supernus’ neuropsychiatry portfolio with the addition of Zurzuvae, the only oral medicine approved by the U.S. Food and Drug Administration (FDA) for the treatment of adults with postpartum depression.

Zurzuvae was co-developed by Sage and Biogen, Inc. (BIIB). Through a collaboration agreement with Biogen, Supernus will report collaboration revenue that is 50% of the total net revenue Biogen records for Zurzuvae in the U.S.

In 2024 alone, Sage recorded a collaboration revenue of $36.1 million from net sales of Zurzuvae.

Jack Khattar, President and CEO of Supernus Pharmaceuticals, said the acquisition augments the company’s growth profile by adding a fourth growth product to its portfolio, in addition to Qelbree, Onapgo, and Gocovri.

The acquisition is also expected to be significantly accretive in 2026, with cost synergies of up to $200 million on an annual basis, the companies said.

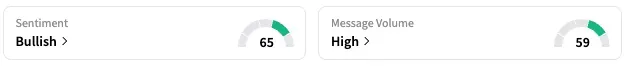

On Stocktwits, retail sentiment around SUPN jumped from ‘neutral’ to ‘bullish territory over the past 24 hours, while chatter increased from ‘normal’ to ‘high’ levels.

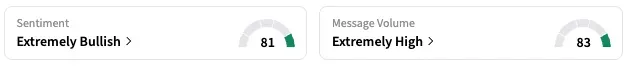

Meanwhile, sentiment around SAGE increased from ‘neutral’ to ‘extremely bullish’ territory while message volume increased from ‘normal’ to ‘extremely high’ levels.

This year, SAGE stock has risen 56% while SUPN stock fell about 10%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_strait_of_hormuz_jpg_456f2fb6d3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)