Advertisement|Remove ads.

Sweetgreen Stock Jumps After-Hours As CEO Scoops Up Nearly $1M In Shares: Retail Bets On Profitability After Spyce Sale

- Sweetgreen shares gained over 6% in the after-market session, a rebound following the company’s recent earnings report and divestiture of Spyce.

- The company acquired Spyce, a robotics firm that offers systems to automate kitchen tasks, enabling high throughput, for $70 million in 2021.

- Sweetgreen reported Q3 results below expectations last week and lowered its annual sales forecast.

Sweetgreen, Inc.’s shares surged 6.3% in the after-market session on Wednesday following a $1 million share purchase by CEO Jonathan Neman.

Neman bought 179,700 shares of the company on Wednesday, according to an exchange filing. Share purchases by senior management are typically considered a sign of confidence in the business.

The gains are a welcome development for Sweetgreen’s shares, which plunged to an all-time low after the company’s quarterly report last week. The company’s third-quarter same-store sales declined 9.5% as foot traffic dropped, prompting it to lower its annual sales view by about $23 million.

Spyce Divestiture

The company also announced the sale of its Spyce business for over $186 million, although it will continue to use the latter’s Infinite Kitchens automation model under license.

Sweetgreen acquired Spyce, a robotics firm that offers systems to automate kitchen tasks, enabling high throughput, for $70 million in 2021. In the years since, Sweetgreens expanded Spyce’s Infinite Kitchens system and integrated it in over 20 of its restaurants.

CEO Jonathan Neman said on the analyst call last week that Spyce’s technology remains “central to Sweetgreen’s future,” even as the divestiture aims to “unlock greater scale, lower operating costs, and strengthen [its] financial foundation for the future.”

Retail And Analyst View

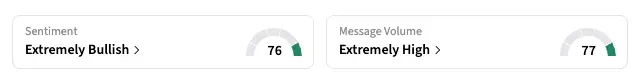

On Stocktwits, the retail sentiment for SG has held in the ‘extremely bullish’ since the company’s announcements on Nov. 6, with ‘extremely high’ message volume.

“Guess I was right on time with me adding the last 2 days,” said one user, referring to the CEO stock purchase news. “This name was too cheap too ignore.”

In an investor note published this week, Citi analysts stated that they believe Sweetgreen’s U.S. sales will rebound as the government emerges from a shutdown in the coming weeks, given its exposure to markets in and around Washington, D.C, according to a summary on The Fly. The research firm placed an "upside 90-day catalyst watch" on Sweetgreen, while keeping a ‘Buy’ rating on the stock.

Sweetgreen, which serves customizable salads and bowls across more than 266 U.S. locations, reshaped the quick-service industry after its 2007 launch by proving that healthy food can be both accessible and convenient. Yet, the company has struggled to achieve sustained profitability — something it hopes to move closer to following the divestiture of its Spyce robotics unit.

So far this year, the SG stock has declined 83.3% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Remember Parag Agrawal? Ex-Twitter CEO Fired By Elon Musk Quietly Raises $100M For His AI Startup

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)