Advertisement|Remove ads.

Swing Trade Idea: Voltas Clears Key Resistance, SEBI RAs Eye ₹1,450-1,480 Target

Voltas, which has been under heavy selling pressure this year, has been steadily reversing the trend over the past few weeks. The stock has gained approximately 11% over the past month.

According to SEBI-registered analyst Financial Independence, the stock has formed a solid base around the ₹1,200 level and recently broke out above a key resistance zone between ₹1,350 - ₹1,370, signaling renewed buying interest.

From a technical perspective, the chart is forming a higher-high, higher-low pattern, supported by a noticeable rise in volume, which reinforces the bullish momentum, they said.

The Relative Strength Index (RSI) stands at 67.8, reflecting strong momentum, though edging toward the overbought zone, they said, recommending partial profit booking and adjusting the stoploss level.

If the stock sustains above ₹1,385, it could move toward the ₹1,440 - ₹1,480 range in the near term, a 7% upside. On the downside, immediate support lies between ₹1,325 - ₹1,345, with a key stop-loss zone placed below ₹1,300.

At the time of writing, Voltas stock was trading at ₹1,371, up 2.9%.

Taking up positions during the dip toward the support zone could offer a favorable risk-reward opportunity, Financial Independence said.

Srinivasa Reddy, another SEBI-registered analyst, supported the bullish outlook. He noted that the stock is breaking out of a long consolidation phase and showing strength ahead of Q1 results, which could result in a potential swing trade opportunity.

He set a target price of ₹1,450 to be achieved by July 25.

In other news, the air conditioner maker received a GST (Goods and Services Tax) show-cause notice of approximately ₹265.25 crore. related to a merged entity. The notice relates to the alleged short payment of GST by Universal Comfort Products for FY2018-19 to FY2020-21. The notice seeks an explanation as to why the amount, along with interest and penalty, should not be recovered from Voltas.

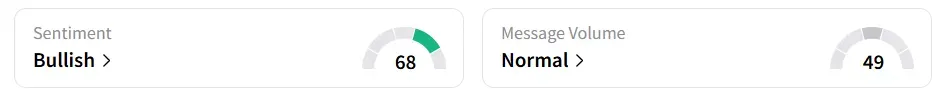

Data on Stocktwits shows that retail sentiment remained ‘bullish’.

Year-to-date, the stock has shed over 23%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)