Advertisement|Remove ads.

SpringWorks Therapeutics Leads Biotech Pack In Weekly Retail Follower Surge: What's Fueling Interest?

SpringWorks Therapeutics (SWTX) saw the biggest retail follower increase among biotech stocks last week on Stocktwits, even as its shares tumbled more than 14%, marking their worst weekly decline since mid-January.

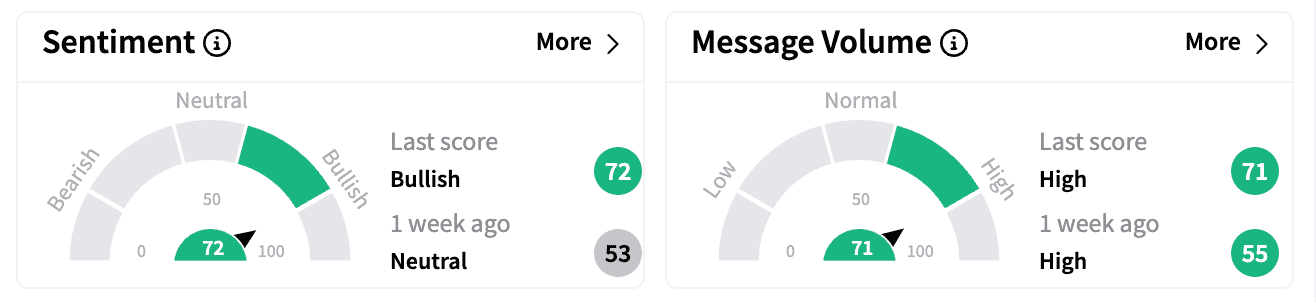

Despite the drop, retail sentiment flipped to 'bullish' from 'neutral,' driven by renewed speculation about German healthcare giant Merck KGaA (MKGAY) confirming details about a buyout.

According to The Fly, Barclays analyst Peter Lawson noted that some investors had anticipated confirmation of an acquisition from Merck's earnings report last week.

However, Merck's annual report, published Thursday, only acknowledged that discussions about a potential merger were at an advanced stage but stated that there was no certainty a deal would be signed.

The absence of a definitive announcement left traders analyzing the language for clues.

Adding to speculation, SpringWorks canceled its planned appearance at Barclays' healthcare conference this week, continuing a pattern of event withdrawals following the FDA approval of its lead drug, Gomekli, for treating neurofibromatosis type 1 (NF1).

The company had previously backed out of an earnings call and another public event, fueling investor theories that a significant corporate development was underway.

Barclays maintained an 'Overweight' rating on SpringWorks, with a price target of $63. It sees limited regulatory risk to a potential Merck buyout.

Retail traders on Stocktwits reacted strongly to these developments. Message volumes surged, and the company's follower count increased by 17.9%, the highest among all biotech stocks last week.

Some investors speculated that an acquisition could be announced this week, with one suggesting a potential offer price of $120 per share — a 140% premium to SpringWorks' last closing price.

Another pointed to Merck not disclosing a termination of negotiations, which German law would have allegedly required if talks had ended, and reaffirmed their belief in SpringWorks' leadership.

According to Koyfin, short interest in SpringWorks has declined from 15.7% at the start of the year to 12.2% last week, suggesting that bearish bets against the stock have been easing.

The company's shares currently trade at a 47% discount to the average analyst price target of $72.88. Five of the eight analysts covering SpringWorks have a ‘Buy’rating, while three rate it a ‘Strong Buy,’ according to Koyfin.

Despite last week's sharp decline, SpringWorks remains up more than 36% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_pharma_stock_jpg_c9a7452f1f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228080229_jpg_dba4a8dbc2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)