Advertisement|Remove ads.

Critical Metals Anticipates Closing Rare Earths Supply Deal In Greenland By Q1 2026: Report

- The rare earths company has already completed the sale of 75% of the planned output to the U.S. and Europe, CEO Tony Sage said.

- Critical Metals would also be open to investments from Washington, CEO Sage told Reuters.

- The company is seeking a diversified supply to limit geopolitical risk.

Critical Metals Corp. (CRML) is reportedly expected to finalize its rare earths project in Greenland by the first quarter of 2026.

The company’s chief executive officer, Tony Sage, told Reuters that the remaining 25% of off-take agreements for its rare earths Tanbreez project in south Greenland is likely to be completed early next year, and the company would be open to an investment from Washington. As per an earlier Reuters report, Trump administration officials were considering a stake in Critical Metals.

Critical Metals has already completed the sale of 75% of the planned output to the U.S. and Europe, according to the report. The company is looking to keep its supply diversified to limit geopolitical risk, Sage said.

Shares of CRML climbed 0.14% on Wednesday morning at the time of writing.

Rare Earths Interest

Growing interest from the Middle East indicates that energy-rich states are making efforts to build rare-earth processing capacity, Sage told Reuters. This includes potential processing partners in Saudi Arabia, Qatar, Bahrain, Oman, and the U.A.E., as well as the lower power costs and faster permitting than in the U.S. and Europe.

The U.S. is aiming to reduce its reliance on China for critical minerals, which is currently the leader in the space. The Trump administration is stepping up efforts to strengthen domestic supply chains for critical minerals amid escalating trade tensions with the Asian country.

Earlier this month, President Donald Trump touted Greenland as an important part of U.S. national security, adding that he had appointed a special envoy to the island to lead the charge.

Tanbreez Deposit

Tanbreez in Greenland is among the largest known rare-earth deposits in the world, with some estimates suggesting that it contains over 27% of heavy rare-earth elements. The site also provides an important supply chain advantage because of its direct shipping access to the North Atlantic Ocean.

Critical Metals’ recent joint venture with a Romanian state-owned company gives it long-term rights to 50% of Tanbreez output and raises the company’s total Tanbreez offtake to 75%.

How Did Stocktwits Users React?

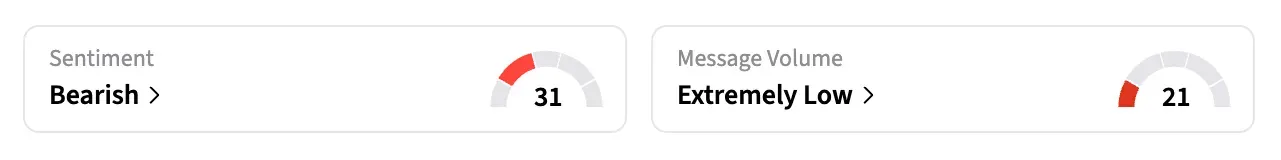

On Stocktwits, retail sentiment around CRML shares trended in the ‘bearish’ territory over the past day amid ‘low’ message levels.

Shares of CRML have gained over 5% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1710397990_jpg_c2ac3394d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2244297865_jpg_34f8b38611.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)