Advertisement|Remove ads.

T. Rowe Price Stock Falls After Q4 Profit Miss: Retail Turns Extremely Bearish

T. Rowe Price Group Inc. (TROW) shares fell 4.5 % on Wednesday after the company’s fourth-quarter earnings missed Wall Street estimates.

On an adjusted basis, the company reported earnings of $2.12 per share, compared to average analysts’ estimate of $2.20 per share, according to FinChat data.

Its quarter-end assets under management (AUM) fell 1.5% sequentially to $1.61 trillion but registered an 11.2% year-over-year growth.

The company’s quarterly revenue of $1.82 billion also fell short of an estimated $1.87 billion.

The investment manager’s adjusted operating expenses rose 7.2% sequentially due to higher

compensation costs related to the firm's annual long-term incentive grant, higher employee benefit costs, and a higher bonus accrual.

Compared to last year, T. Rowe’s investment advisory fees rose 16% to $1.67 billion. However, its performance-based advisory fees fell by 23.7% to $19.3 million.

The company’s equity advisory fees jumped 16.4% to $1.01 billion.

In January, larger peer BlackRock had topped Wall Street estimates for quarterly profit.

Investors domiciled outside the United States accounted for 8.8% of the firm's AUM on Dec. 31, 2024, compared to 8.6% at the end of the third quarter.

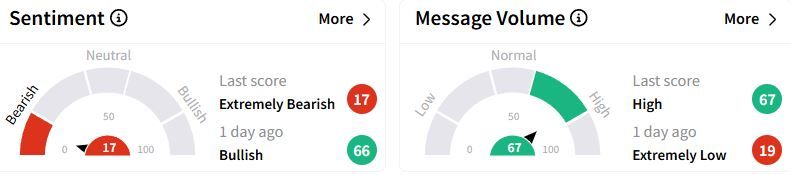

Retail sentiment on Stocktwits plunged to ‘extremely bearish’ (17/100) territory from ‘bullish’(66/100) a day ago, while retail chatter rose to ‘high’ from ‘extremely low.’

Over the past year, the stock has gained nearly 2%.

Also See: Prudential Financial Stock Slips After Q4 Profit Misses Estimates: Retail Stays Bearish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Palantir_jpg_d29fd424cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217223717_jpg_e05dddbc9f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_sea_ltd_jpg_b4cc09a88d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219834417_jpg_a7705b50b5.webp)