Advertisement|Remove ads.

Prudential Financial Stock Slips After Q4 Profit Misses Estimates: Retail Stays Bearish

Prudential Financial (PRU) shares fell 4.3% on Wednesday after the company’s fourth-quarter profit missed the Wall Street estimate.

According to Koyfin data, the company reported operating earnings of $2.96 per share on an adjusted basis for the three months ended Dec. 31, compared to the average analysts’ estimate of $3.26 per share.

It also posted a net loss of $57 million or $0.17 per share, compared with a net income of $1.32 billion, or $3.61 per share in the year-ago quarter.

The insurer’s U.S. businesses adjusted operating income fell to $860 million for the fourth quarter, compared to $964 million last year.

This decrease was primarily attributed to higher expenses related to one-time transaction impacts associated with closing the Guaranteed Universal Life reinsurance deal, as well as lower net fee income, and less favorable underwriting results.

Global investment management business PGIM’s adjusted operating income increased to $259 million from $172 million in the year-ago quarter, aided by higher asset

management fees and other related revenues, which were driven by higher incentive fees.

Prudential’s assets under management rose to $1.51 trillion compared to $1.45 trillion for the year-ago quarter.

Its International Businesses, consisting of Life Planner and Gibraltar Life & Other services, reported an adjusted operating income of $742 million, marginally lower than $748 million in the year-ago quarter.

The company set a U.S. business earnings growth target at mid-single-digit percentage points.

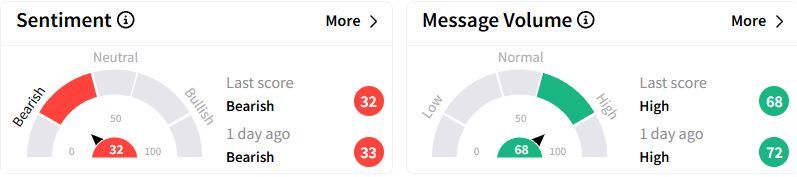

Retail sentiment on Stocktwits moved slightly lower in ‘bearish’ (32/100) territory, while retail chatter remained ‘high.’

Over the past year, Prudential stock has gained 9.9%.

Also See: TotalEnergies Shares Rise After Q4 Earnings Impress Wall Street: Retail’s Unfazed

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)