Advertisement|Remove ads.

Tata Motors Eyes Europe Entry Via Iveco: SEBI RA Flags Clean Tech Edge, Key Levels To Watch

Tata Motors shares fell over 3% on Wednesday after reports emerged that it was looking to acquire Iveco Group's bus business, including the legendary Magirus brand.

This deal, which would be executed through its commercial vehicle arm, Tata Motors Commercial Vehicles (TMCV), positions them as a serious player in the global commercial vehicle (CV) space, especially in electric and alternative fuel mobility, said Varunkumar Patel, a SEBI-registered analyst.

According to the deal, Tata Motors will acquire complete control over Iveco’s bus operations, including global manufacturing facilities, intellectual property, and R&D assets, the Magirus brand, and all associated designs and technology.

While deal value has not been officially disclosed, analysts believe this move is capital-efficient as Tata Motors is acquiring existing capacities and brand equity, avoiding heavy greenfield investments.

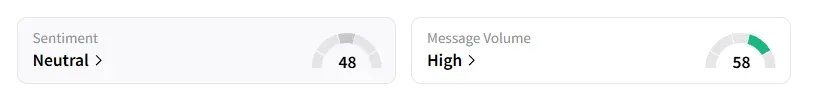

However, data on Stocktwits shows that retail sentiment mirrored the stock weakness, moving from ‘bullish’ to ‘neutral’ amid ‘high’ message volumes.

What Does Tata Motors Gain?

Patel noted that this deal boosts Tata Motors’ entry into Europe and Latin America, building on Iveco’s established presence in these regions. In this way, they gain immediate access instead of building it organically.

Additionally, Iveco has already developed cutting-edge electric and hydrogen bus platforms. With this acquisition, Tata Motors can gain these clean mobility technologies at a time when both countries are pushing for net-zero fleets.

Patel added that by leveraging India as a low-cost manufacturing hub for global markets, Tata Motors can now consolidate R&D, procurement, and production, thereby boosting margins and volumes. And Iveco’s bus network will enable them to scale CV exports and offer full-line electric solutions under both Tata and Magirus brands.

Technical Outlook

Patel observed that Tata Motors' stock was trading in a bullish pattern with higher highs and higher lows, above its 20-day and 50-day Exponential Moving Averages (EMAs). He identified support at ₹665, with resistance at ₹705-₹735. Its Relative Strength Index (RSI) stands near 42, indicating a bearish territory.

He believes that a breakout above ₹735 can lead to swift upside till ₹800 in the short term. Trend remains weak unless it breaks above ₹705 on a closing basis.

Patel concluded that Tata Motors is ‘now playing the global auto game, and it’s playing to win.’

Tata Motors shares have declined 10% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)