Advertisement|Remove ads.

Tata Steel Charts Recovery Path: SEBI RAs See Breakout Above ₹160

Tata Steel shares are in focus on Tuesday after a steady recovery in March-quarter earnings, reigniting bullish sentiment in both fundamental and technical circles.

Consolidated revenue rose to ₹56,218 crore, up from ₹53,648 crore in the December 2024 quarter. Operating profit increased to ₹6,559 crore, maintaining a stable operating margin of 12%.

Net profit jumped to ₹1,201 crore, a sharp improvement from ₹295 crore in Q3 and ₹759 crore in Q2.

The board announced a 131% dividend payout, a strong turnaround from the negative payout in FY24.

On the technical front, SEBI-registered analyst Harika Enjamuri noted that Tata Steel displayed bullish momentum on both daily and weekly charts.

A golden crossover on the daily chart, rising RSI (61.91), and strong volumes suggested upward strength.

In the short term (1–3 days), Tata Steel's price might test ₹155.28 and potentially break through it if trading volume is strong, according to Enjamuri's analysis.

Over the coming weeks, assuming positive market sentiment, Tata Steel could rally towards ₹160–₹169, while ₹144–₹141 will serve as immediate support during pullbacks.

SharesNservices echoed the sentiment, highlighting resistance levels at ₹158–₹160, and a breakout above ₹162 could lead to targets of ₹168, ₹176, ₹182, and even ₹200. Support was seen at ₹120–₹125, indicating limited downside.

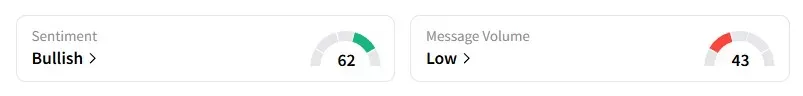

Data on Stocktwits shows that retail sentiment is ‘bullish’ on the counter.

Tata Steel shares gained 8% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)