Advertisement|Remove ads.

TCS Q1 Preview: Earnings Guidance Could Be Turning Point For Stock, Says SEBI RA Rohit Mehta

All eyes turn to Indian IT blue chip Tata Consultancy Services (TCS) ahead of its Q1 FY26 earnings on July 10.

Currently trading at ₹3,402, TCS is down over 23% from its all-time high of ₹4,458 hit in August 2024. The stock is hovering around a crucial support zone, and the upcoming results could set the tone for its next big move.

Technically, TCS shares have been consolidating near support levels of ₹3,370 - ₹3,431, with ₹3,200 as the next key level if they break lower, according to SEBI-registered analyst Rohit Mehta. Resistance can be observed in the ₹3,600-₹3,700 range.

A previous cup-and-handle pattern failed to hold after a breakout, but a bounce is possible if the earnings surprise on the upside, he added.

Q1 Earnings: What To Watch?

Mehta noted that key indicators to track for TCS are revenue growth, particularly from the BFSI (banking, financial services, and insurance) sector and North America, as well as key deal wins and updates on hiring and margin pressure.

According to Bloomberg estimates, Q1 revenue is expected to be 3.2% higher at ₹64,627.9 crore versus ₹62,613.20 crore, while profit is expected to be little changed at ₹12,251 crore versus ₹12,224 crore. TCS EBIT is expected to be 1% higher at ₹15,703 crore compared to ₹15,601 crore. And EBIT Margin is seen at 24.29% versus 24.91%.

TCS remains a fundamentally strong company with a 3-year average ROE of 50.3% and an 83.8% dividend payout. However, high valuation at 13x book value and muted topline growth over the last five years remain a concern, the analyst said.

Shareholding Trend

Promoter ownership remained stable during the quarter, while foreign institutional investors (FIIs) trimmed their stake from 12.68% to 12.04%, and domestic institutional investors (DIIs) raised theirs to 11.49%.

With the market cautious of the margins of IT companies and TCS underperforming the Nifty index, the Q1 results and guidance could be the catalyst for a decisive move as the stock hovers near a make-or-break zone, Mehta said.

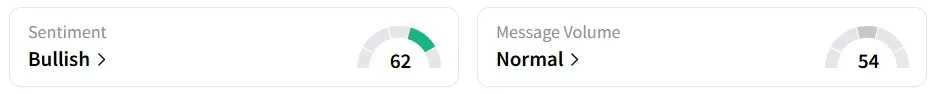

Retail sentiment on Stocktwits turned ‘bullish’ from ‘neutral’ a week earlier.

Year-to-date (YTD), the stock has shed over 15% of its value.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_92efa5a8c7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Visa_resized_82d951e81e.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1218279776_jpg_d381694a09.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199360480_jpg_41abd97106.webp)