Advertisement|Remove ads.

TD Bank Stock Gains After Announcing Sale Of Charles Schwab Stake: Retail’s Still Bearish

TD Bank Group (TD) stock rose 3.5% on Monday after the company agreed to sell its entire stake in Charles Schwab Corp (SCHW).

The Canadian bank said it currently owns 184.7 million shares of Schwab's common stock, representing a 10.1% stake in the company.

Schwab shares fell 2.6% in afternoon trade.

The bank said that TD Securities and Goldman Sachs would be the joint book-running managers on the offering.

The bank said it would use C$8 billion (USD5.59 billion) from the proceeds to buy 100 million of its common shares, representing about 5.7% of its outstanding shares.

“We will invest the balance of the proceeds in our businesses to further support our customers and clients, drive performance, and accelerate organic growth," the company said in a statement.

Under new CEO Raymond Chun, who took office on Feb. 1, TD is looking to move beyond the controversies related to its lapses in preventing money laundering.

TD Bank said it would continue to have a business relationship with Schwab through the Insured Deposit Account (IDA) agreement.

In October, the bank agreed to pay $3.1 billion in fines and other penalties to the Department of Justice and other financial regulators.

The Treasury Department had said that TD’s failures to prevent laundering provided a ‘fertile ground for illicit activity,’ which included fentanyl and narcotics trafficking to terrorist financing.

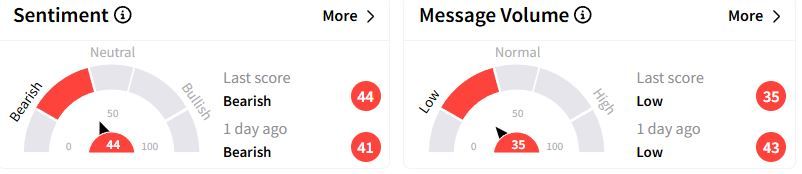

Retail sentiment on Stocktwits about TD remained in ‘bearish’(44/100) territory, albeit with a higher score, while retail chatter remained ‘low.’

One user expressed his joy that his bet on the TD Bank stock had paid off.

Over the past year, TD stock has gained 1.1%.

The bank is scheduled to post its earnings on Feb. 27 before the market opens.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: 1 CAD = 0.7 USD

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230437216_jpg_6078a75ee4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149037439_jpg_ab9f73d5f7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2205870374_jpg_15fedc8d2f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_berkshire_hathaway_jpg_86250c27d6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)