Advertisement|Remove ads.

Tempus AI Stock Swings Wildly As Earnings Near, Retail’s Cautiously Optimistic After Insider Sales

Shares of Tempus AI, Inc. were volatile Tuesday, surging to highs last seen in mid-November before paring gains to trade slightly higher.

Trading volume was nearly double the daily average as the healthcare tech firm confirmed it will report fourth-quarter and full-year 2024 earnings on Feb. 24, with a conference call at 4:30 p.m. ET.

Wall Street expects the company to report an adjusted loss of $0.16 per share on revenue of $203.12 million.

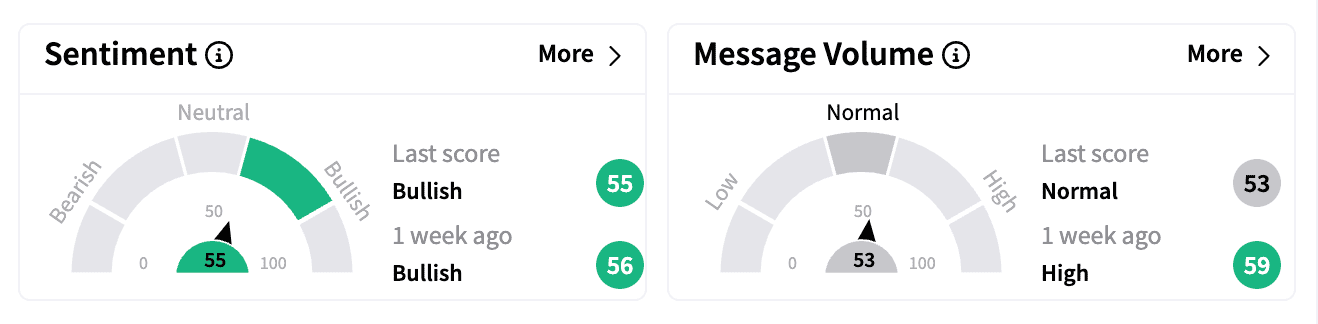

Retail sentiment on Stocktwits remained ‘bullish,’ though the score read slightly lower than last week following insider selling.

CEO and Chairman Eric Lefkofsky recently sold nearly 240,000 shares between Feb. 5-7, netting over $16.2 million, while CFO Jim Rogers sold 8,712 shares for $588,669, as per SEC filings.

Stocktwits users had mixed reactions. One trader noted the stock “gave back most of the pump,” suggesting weak holding interest amid short pressure.

Another pointed to a bullish technical setup, predicting a move toward $80.

Tempus AI has gained a lot of attention since launching an AI-enabled personal health app last month.

But it also made headlines after former House Speaker Nancy Pelosi purchased 50 call options in the stock, a trade closely watched by retail investors.

Last week, the company announced the completion of its $600 million acquisition of Ambry Genetics.

TD Cowen reportedly believes the acquisition strengthens Tempus with a $300-million profitable lab, enhances product offerings, and accelerates its path to positive free cash flow.

The research firm, however, thinks Ambry’s slower growth is a concern.

Tempus AI stock has surged over 70% since its June 2024 IPO, with its Stocktwits following up nearly 700% in three months.

Short interest has also climbed from 3.9% at the start of 2025 to 7.3% by the end of January, per Koyfin data.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2264020227_jpg_4d7420bef3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259210190_jpg_d48bbe3269.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1396534113_jpg_b0e09f299b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)