Advertisement|Remove ads.

Tesla Is ‘Behind Everyone Now’ Says Ross Gerber After Nvidia Alpamayo Launch

- There are many robot builders and users, “but the real winners will be the companies that employ advanced robotics first,” Gerber said, tagging Nvidia.

- Gerber’s comments come after Nvidia launched its ‘Alpamayo’ AI models aimed at enabling reasoning-based autonomous vehicle development.

- Gerber also predicted that autonomy will become a standard feature in vehicles this decade.

Tesla Inc. (TSLA) is lagging behind its competitors, who have surpassed the automaker’s technological advantage, Ross Gerber, CEO and co-founder at investment firm Gerber Kawasaki, said on Tuesday.

In an X post, the early Tesla backer said that founder Elon Musk’s year off in government gave the competition time to catch up. “They are behind everyone now,” Gerber said in his post. “They have and in some cases surpassed Tesla's technology advantage. Now it's a race.”

Gerber’s comments come after NVIDIA Corp. (NVDA) unveiled its ‘Alpamayo’ open AI models at the Consumer Electronics Show (CES) 2026 that are aimed at enabling reasoning-based autonomous vehicle development.

There are many robot builders and users, “but the real winners will be the companies that employ advanced robotics first,” Gerber added, tagging Nvidia.

Tesla Vs Nvidia

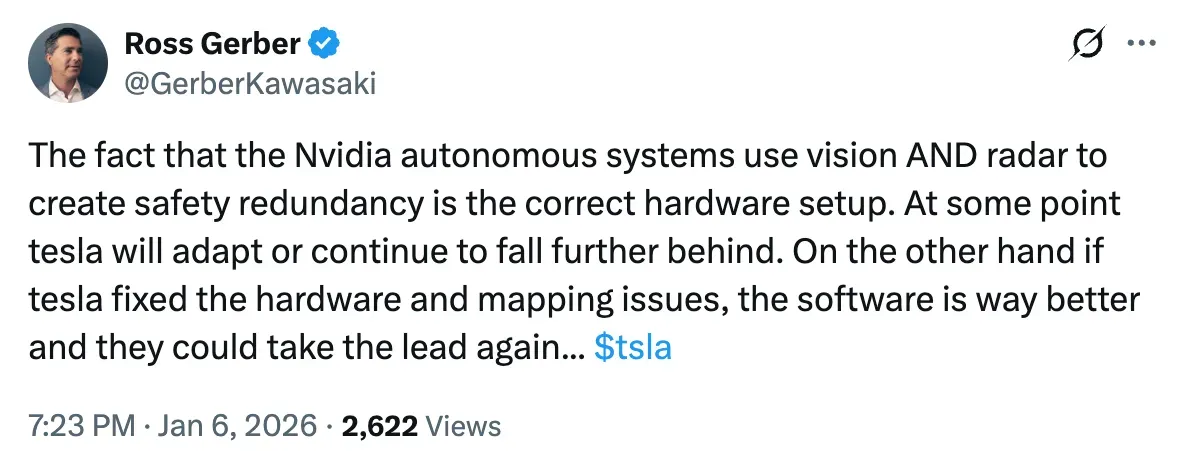

Praising Nvidia, Gerber said that the chipmaker’s use of vision and radar to create safety redundancy in its autonomous systems is the correct hardware setup.

Comparing it to Tesla, Gerber said that the carmaker will have to adapt at some point or continue to fall further behind. However, if Tesla were to fix its hardware and mapping issues, the software could improve and put them in the lead again, he added.

Tesla's robotaxis have been under scrutiny for multiple issues including traffic violations, defects, and crashes, among others, raising concerns over its full self-driving (FSD) tech.

Nvidia’s autonomous vehicle tech would compete directly with Tesla’s. Nvidia CEO Jensen Huan said that the company is working to build a self-drive car using its new tech, expected to be released in the U.S., Europe, and Asia soon.

“This next stage of creating Nvidia brains for robotics will increase manufacturing productivity for a long time into the future,” said Gerber. “Autonomy will become a standard feature in vehicles this decade. Tesla should start giving it away to sell cars asap. Same with robotaxi,” he added.

Separately, Musk reacted to Nvidia’s Alpamayo model earlier on Monday, noting

that Tesla is already doing what Nvidia intends to, adding that while getting to 99% is easy, the real challenge lies in the long tail of the distribution.

How Did Stocktwits Users React?

On Stocktwits, retail sentiment around TSLA stock was in the ‘extremely bearish’ territory over the past 24 hours amid ‘high’ message volume at the time of writing.

Meanwhile, retail sentiment around NVDA shares jumped to ‘bullish’ from ‘bearish’ territory over the past 24 hours amid a jump to ‘high’ message volume from ‘low’ a day before.

One user commented that with Alpamayo on the horizon, the market for Tesla’s FSD and robotaxis could shrink considerably.

Shares of TSLA were down over 4% in Tuesday's morning trade while they have gained over 5% in the past year.

Meanwhile, shares of NVDA rose marginally by 0.15% on Tuesday at the time of writing and have surged over 26% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2219201717_1_jpg_a4257a5acc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_jpg_e07360ccae.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)