Advertisement|Remove ads.

Tesla Price Target Hiked By Goldman Sachs Despite Q2 Delivery Drop: Analysts Point To ‘Meaningfully Better’ Numbers

Goldman Sachs analyst Mark Delaney on Thursday raised its price target on Tesla Inc (TSLA) to $315 from $285, despite the company reporting a year-on-year drop in second-quarter delivery numbers on Wednesday.

The firm kept a ‘Neutral’ rating on the shares.

Its new price target represents a 0.2% downside from the stock’s closing price on Wednesday.

While the second-quarter (Q2) delivery numbers were down 13.5% year-on-year (YoY) and below the consensus estimate, it was still "meaningfully better" than Goldman's 365,000 forecast and investor expectations, the analyst noted.

Tesla’s Q2 performance marks the second consecutive quarter when the EV giant has reported a drop in deliveries. The company reported deliveries of 384,122 units in the three months through June, down from the 443,956 units reported in the second quarter of 2024.

The stock snapped a six-day losing streak on Wednesday, closing up nearly 5% at $315.65.

RBC Capital analyst Tom Narayan on Wednesday said the delivery numbers were "impressively" 5% above the firm's 366,000 unit expectation.

RBC has an ‘Outperform’ rating and $307 price target on Tesla shares.

Cantor Fitzgerald, meanwhile, believes Tesla benefits from future upside from its Full Self-Driving (FSD) software and the upcoming robotaxi segment, the introduction of lower-priced models, a global manufacturing footprint with economies of scale, and the industry's largest charging infrastructure. The firm also thinks Tesla will benefit from an acceleration of AI, software, and fleet-based profit.

Cantor has an ‘Overweight’ rating on the shares with a price target of $355.

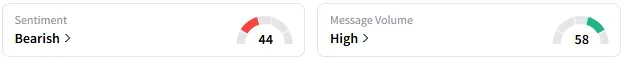

On Stocktwits, retail sentiment around Tesla is trending in the ‘bearish’ territory accompanied by ‘high’ message volume.

TSLA stock is down by 22% this year and up by 28% over the past 12 months.

Read Next: Krispy Kreme Names Insider Raphael Duvivier As New CFO A Week After Ending McDonald’s Partnership

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)