Advertisement|Remove ads.

Tesla Retail Investors Threaten Charles Schwab Exodus Over Votes Against Elon Musk’s $1 Trillion Pay Plan

- Tesla influencers Sawyer Merritt and Jason DeBolt warned they would transfer their holdings from Charles Schwab if the brokerage fails to support Elon Musk’s 2025 CEO Performance Award plan.

- CalPERS and several major U.S. funds said they will vote against Musk’s $1 trillion compensation package, citing governance and concentration-of-power risks.

- On Stocktwits, sentiment was bearish, though some retail traders predicted a sharp rally toward $580–$600 if the pay plan is approved.

Prominent Tesla Inc. retail investors have warned they may withdraw their holdings from Charles Schwab & Co. after learning that several of the brokerage’s ETF funds voted against Tesla’s management proposals, including the ratification of CEO Elon Musk’s 2018 performance-based stock-option plan and the company’s redomiciliation from Delaware to Texas.

Investor and influencer Sawyer Merritt said on X that if Schwab does not support Musk’s upcoming 2025 CEO Performance Award plan, he will “move all my assets to another brokerage,” adding that many of his followers, who collectively hold “hundreds of millions in $TSLA” through Schwab accounts, may do the same.

“I can’t in good conscience stay with a brokerage that votes against this CEO Performance Award plan that is in my view clearly in shareholders’ best interests,” Merritt said, joining fellow investor Jason DeBolt in urging Schwab to align with Tesla’s leadership.

DeBolt, a Tesla shareholder since 2013, said on X that he has requested contact with Schwab’s Private Wealth Services team, calling the issue “urgent.” He claimed that at least six Schwab ETF funds representing around 7 million Tesla shares voted against Tesla’s board recommendations at the 2024 annual meeting.

“My 240,000+ Tesla investor followers are asking why Schwab would oppose one of the most successful corporate boards in history,” DeBolt said.

He added that his community is prepared to transfer “tens of millions in $TSLA shares (or possibly hundreds of millions)” to another broker.

Within the trillion-dollar market-cap club, Tesla stands out as more of a "retail stock" than the others, according to a Barron's article from July. More than 40% of the EV maker's shares available to trade are reportedly held by smaller retail investors.

Schwab’s Proxy Record Shows Opposition

According to Schwab’s public proxy-voting disclosure, the Schwab U.S. Broad Market ETF voted against Tesla’s proposal to ratify the 100% performance-based stock-option award to Musk, first approved in 2018. The fund also opposed Tesla’s redomiciliation to Texas but supported management on advisory votes on advisory pay and on the audit. The disclosure shows Schwab cast 1.5 million shares at the June 13, 2024, meeting.

Plan Overview And Musk’s Push

The 10-year compensation plan ties Musk’s pay to performance milestones in market value, profitability, and innovation. If all targets are met, his ownership stake could rise to about 25%. Musk has been appealing directly to investors, arguing that the package links his rewards to long-term shareholder value. During Tesla’s latest earnings call, Musk criticized proxy advisers ISS and Glass Lewis, both of which recommended voting against the plan. Shareholders are set to vote on the proposal on Thursday.

Wall Street Divide Deepens

The California Public Employees’ Retirement System (CalPERS), which holds about 5 million Tesla shares, said it would vote against Musk’s proposed $1 trillion pay package, calling it excessive and warning it could concentrate power in one shareholder, Bloomberg reported. The fund joins a list of institutional critics, including the New York State and City Comptrollers, the “Take Back Tesla” coalition, SOC Investment Group, proxy advisers ISS and Glass Lewis, and investor Ross Gerber.

Supporters of the plan include Tesla Chair Robyn Denholm, who said Musk “gets nothing unless shareholders enjoy exceptional returns,” along with Florida’s State Board of Administration, Cathie Wood’s ARK Invest, Dan Ives of Wedbush, Gary Black of The Future Fund, Tom Nash, and CNBC’s Jim Cramer, who said Musk is “actually worth” the award.

Tesla has defended the plan as fair and performance-based, arguing ISS and Glass Lewis misjudged the earlier 2018 award.

Stocktwits Turns Bearish Despite Musk Rally Hopes

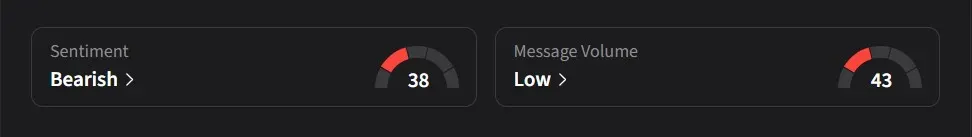

On Stocktwits, retail sentiment for Tesla was ‘bearish’ amid ‘low’ message volume.

One user said they would support Musk’s trillion-dollar performance-based compensation plan, while another predicted that Tesla shares could surge to between $580 and $600 if the proposal passes, describing it as “the largest gamma squeeze by far.”

Tesla’s stock has risen 16% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2207049226_jpg_7f1e685123.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tariffs_jpg_d7661eb31a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)