Advertisement|Remove ads.

Tesla’s Cybertruck Boss Quits After Recalls And Lawsuits Rock Elon Musk’s Most Hyped Vehicle

- The departure follows an October recall affecting about 10% of all Cybertrucks sold and multiple lawsuits tied to design flaws.

- Tesla has raised Cybertruck prices, halted its cheapest model, and expanded sales to the UAE and South Korea amid weak U.S. demand.

- Both the Cybertruck and new Model 3 missed top safety ratings in September, adding pressure as Tesla pivots toward AI and robotics initiatives.

Tesla’s Cybertruck program head has left the company after eight years, bringing to a close a volatile stretch for the stainless-steel pickup marked by safety recalls, lawsuits, and weaker-than-expected sales. The exit follows months of quality setbacks and declining delivery momentum for one of Tesla’s most ambitious vehicles.

Eight-Year Veteran Departs Amid Mounting Challenges

The executive, who joined Tesla as an intern in 2017 and rose through the ranks to lead the Cybertruck program, announced his departure on X on Sunday, calling it “one of the hardest decisions” of his life.

He said the experience of working on the Model 3, Gigafactory Shanghai, and the Cybertruck before turning 30 was “a privilege,” and thanked CEO Elon Musk and other leaders for their mentorship. The post came just days after Tesla shareholders approved Musk’s $1 trillion compensation plan, reaffirming his leadership as the company pivots toward artificial intelligence and robotics.

Recalls, Lawsuits, And Declining Deliveries

The departure comes less than two weeks after Tesla issued a recall on Oct. 30 affecting 6,197 Cybertrucks — about 10% of those sold — due to incorrect adhesive use on the “Off-Road Lightbar” attachment, which could detach while driving, according to a report by Electrek.

Earlier in October, two Bay Area families filed a lawsuit alleging that faulty Cybertruck door handles prevented their teenage children from escaping a crash that resulted in three deaths. The same month, some owners reported apparent exterior damage that was later traced to a factory defect rather than vandalism.

Tesla’s July delivery data suggested that Cybertruck sales had dropped to about 5,000 units per quarter, a sharp contrast to the company’s initial plan to produce more than 250,000 units annually.

Tesla Raises Prices, Expands Overseas

In August, Tesla raised the price of its top-end Cybertruck “Cyberbeast” model by $15,000 and discontinued the cheapest version after sluggish demand. The company has since turned its attention abroad, launching the Cybertruck in September in the United Arab Emirates and in October in South Korea, which are its first two international markets for the vehicle.

Broader Pressure On Tesla’s EV Strategy

Tesla’s broader lineup has also faced scrutiny. In September, the Cybertruck and new Model 3 both missed top safety ratings in the Insurance Institute for Highway Safety’s latest crash tests. Meanwhile, tightening EV tax credit rules and rising competition from rivals such as Rivian and BYD are adding to pressure on Tesla’s margins.

The company is banking on new product cycles and its AI-driven roadmap, including robotaxis and humanoid robots, to offset slowing vehicle sales.

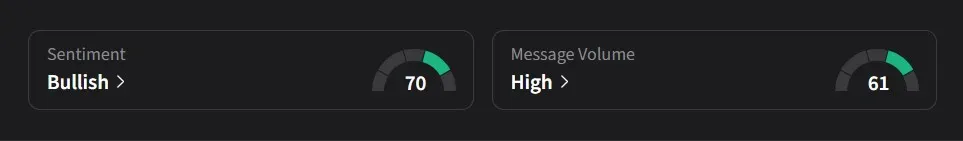

Stocktwits Users Show Bullish Mood

On Stocktwits, retail sentiment for Tesla was ‘bullish’ amid ‘high’ message volume.

Tesla’s stock has risen 6% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_tandem_diabetes_resized_jpg_5f199c73c6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_82880353_jpg_0f9b1c5046.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_applovin_OG_jpg_12b141cd06.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robinhood_jpg_ffd49b668a.webp)