Advertisement|Remove ads.

Tesla’s Self-Driving Ambitions Could Add $1 Trillion To Valuation In 2026, Says Dan Ives

- Dan Ives said 2026 could be the most important year for Tesla.

- According to Ives, Tesla’s self-driving capabilities could potentially add a trillion dollars to the company’s overall valuation.

- Ives predicted Tesla could capture roughly 80% of the autonomous vehicle market in the coming years.

Dan Ives, managing director at Wedbush Securities, reportedly said on Tuesday that Tesla Inc. (TSLA) is positioning itself for a pivotal year in 2026 as the company advances its autonomous vehicle technology.

Speaking to CNBC, Ives stated that he views 2026 as a milestone for CEO Elon Musk and the company’s broader strategy, highlighting autonomous technology as a key growth driver.

“2026 could be the most important year in its history for Musk.”

-Dan Ives, Managing Director, Wedbush Securities

Market Dominance Prediction

According to Ives, Tesla’s self-driving capabilities could create enormous value, potentially adding a trillion dollars to the company’s overall valuation.

“We think autonomous is worth a trillion dollars alone to the Tesla story,” said Ives.

Ives predicted Tesla could capture roughly 80% of the autonomous vehicle market in the coming years. This outlook reflects confidence in the scalability of Tesla’s Full Self-Driving (FSD) system compared with rivals such as Waymo, whose business model and market reach are seen as more constrained.

Tesla stock inched 0.6% higher in Tuesday’s premarket.

Ives Top 5 Stock Picks

On Monday, Wedbush released its top five tech stocks for 2026, featuring Microsoft (MSFT), Apple (AAPL), Tesla (TSLA), Palantir (PLTR), and CrowdStrike (CRWD).

According to Ives, for the first time in 30 years, the U.S. has taken a lead over China in tech through AI. Tesla’s physical AI integration, including its fleet-based data collection and proprietary systems, places it at the forefront of autonomous innovation.

Tesla CEO Elon Musk recently said the company has started testing fully self-driving robotaxis in Austin with no one in the driver's seat, signaling a key step forward for Tesla’s autonomous driving plans.

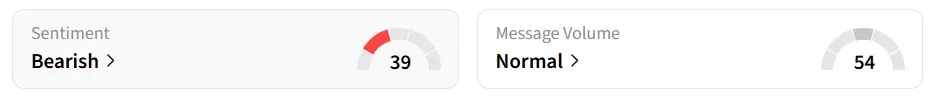

On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory amid ‘normal’ message volume levels.

TSLA stock has gained over 13% year-to-date.

Also See: Energy Fuels Shares Still Overvalued, Says Roth Capital After Production Beat

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2190302521_jpg_796f64970e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194612888_1_jpg_5f7b7f6186.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1384896168_jpg_87fab3f04d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263571605_jpg_f769289486.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233719278_jpg_46dfac21ee.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263454468_jpg_23f4595a31.webp)