Advertisement|Remove ads.

Tesla Stock Slides Back Into The Red This Year As Cathie Wood's Selling Spree, Powerwall Recall, Waymo's Robotaxi Flex Add Pressure

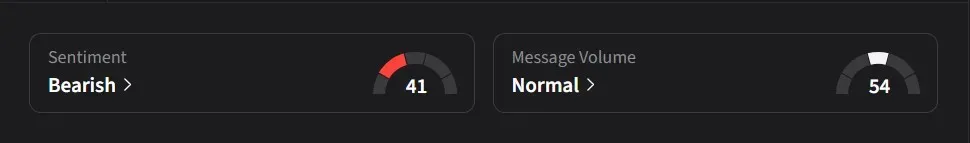

- Stocktwits sentiment flipped bearish, with users warning of pressure toward the mid-$380s and a possible drop near $350.

- Waymo’s highway robotaxi rollout added competitive strain as Tesla’s own pilot still relies on in-car safety monitors.

- Regulatory scrutiny around FSD persisted alongside international setbacks, including battery-management complaints in South Korea.

Tesla shares fell to their lowest level in four months on Thursday, slipping back into negative territory for the year after giving up weeks of steady gains. The move puts the stock down about 0.5% year-to-date, reversing a brief period earlier in 2025 when Tesla had turned positive following a September filing showing CEO Elon Musk purchased roughly $1 billion worth of shares through his family foundation.

ARK Selling Adds Pressure

A significant driver of the latest downturn was persistent selling from longtime Tesla bull Cathie Wood. ARK Invest trimmed its Tesla holdings for the fourth straight session on Wednesday, marking one of its lengthiest selling streaks in months. ARK Innovation and ARK Next Gen Internet sold a combined 70,474 Tesla shares, worth about $30.35 million based on daily disclosures.

Earlier in the week, ARK sold just 789 shares on Tuesday and 5,426 shares on Monday, following a much larger cut of more than 71,000 shares last Friday. Even after the sale, Tesla remains ARK Innovation’s largest position at 11.96% and the largest holding in ARK Next Gen Internet at 9.69%. Across all ARK funds, Tesla still carries a 9.94% weight.

Powerwall 2 Recall

Tesla was also dealing with a new safety recall covering a subset of its Powerwall 2 home battery units. The affected systems contain a defective third-party battery cell that may overheat, release smoke, or in rare cases produce small flames that caused minor property damage.

Tesla said nearly all impacted units in the U.S. have been remotely discharged to render them safe, with remaining systems handled on-site by technicians. All recalled Powerwall 2 units will be removed and replaced at no cost, with scheduling managed through the Tesla app, email, or direct outreach from Tesla and certified installers.

Musk Dismisses Waymo’s Fleet

As pressure mounted, CEO Elon Musk drew attention on X by responding to Tesla influencer Sawyer Merritt, who highlighted Waymo’s 2,500-vehicle robotaxi fleet across major U.S. cities. Musk replied, “Rookie numbers,” a jab at the Alphabet unit just as the competitive gap in autonomy widened.

Beginning Wednesday, Waymo rolled out fully driverless highway service in San Francisco, Los Angeles and Phoenix, becoming the first U.S. operator to offer freeway robotaxi rides without a human driver. The service runs 24 hours a day and provides early access to users who opted in to new features. Waymo also expanded its Bay Area footprint to include San Jose, while maintaining a nationwide deployment of 1,000 vehicles in the Bay Area, 700 in Los Angeles, 500 in Phoenix, 200 in Austin, and 100 in Atlanta.

Tesla currently operates about 30 robotaxis in Austin, according to a report by Electrek. At its 2025 Annual Shareholder Meeting last week, the company also outlined its next expansion targets, naming Las Vegas, Phoenix, Dallas, Houston, and Miami as the next five cities slated to join its autonomous ride-hailing network.

FSD Faces Ongoing Regulatory And International Headwinds

Tesla is also navigating a steady stream of regulatory and international hurdles related to its Full Self-Driving software. In September, U.S. senators pressed federal safety regulators to look into reports that FSD failed to detect railroad crossings. At the same time, nearly 4,500 Tesla owners in South Korea have complained that a battery-management glitch is capping their cars’ charge at 50%. In China, Musk told shareholders that regulators had signaled Tesla could receive full FSD approval by February or March 2026, pointing to a timeline that aligns with the fast-moving autonomy plans of XPeng, Baidu, WeRide, and Pony.ai.

Stocktwits Mood For TSLA Sours

On Stocktwits, retail sentiment for Tesla turned ‘bearish’ amid ‘normal’ message volume.

One user said they expected Tesla shares to face continued pressure into the mid-$380s before entering a period of accumulation that could set up a move toward the $500 level. They added that they planned to watch the stock over the next few weeks to see whether accumulation begins ahead of a potential push higher.

"$TSLA the odds of a dead cat bounce are good," posted one skeptical user. "But let’s not dignify it by calling it a rally. It will fall again after the dead cat bounce. I would use the next big bounce to take profits (others will!) Massively bearish here. The giant momentum wave broke at $470. Double top. Gap down to $350 is likely to fill soon!"

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)